-

A New Pope (From America): More Support For Worker Rights! - 1 day ago

-

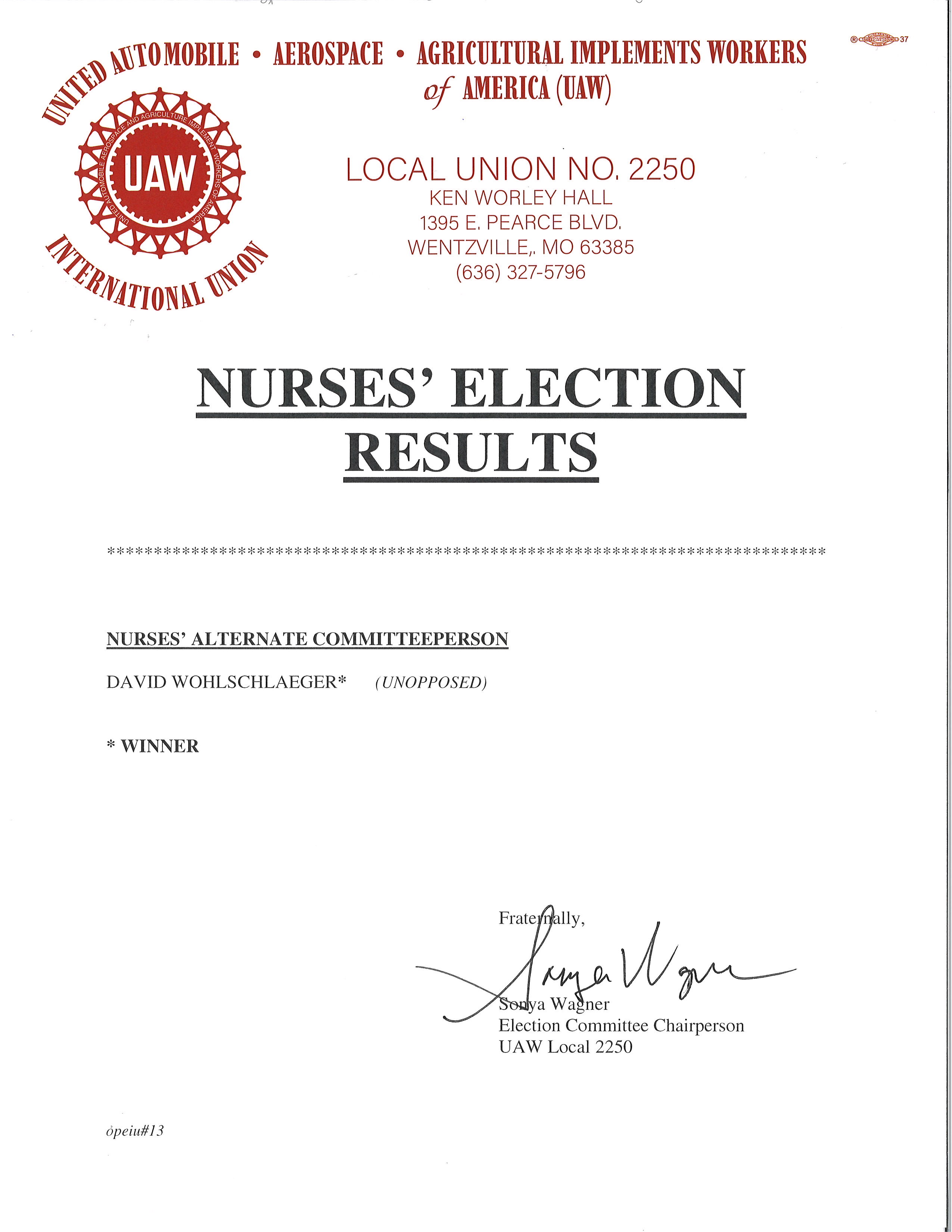

Nurses’ Election Notice: Congratulations Dave! - May 9, 2025

-

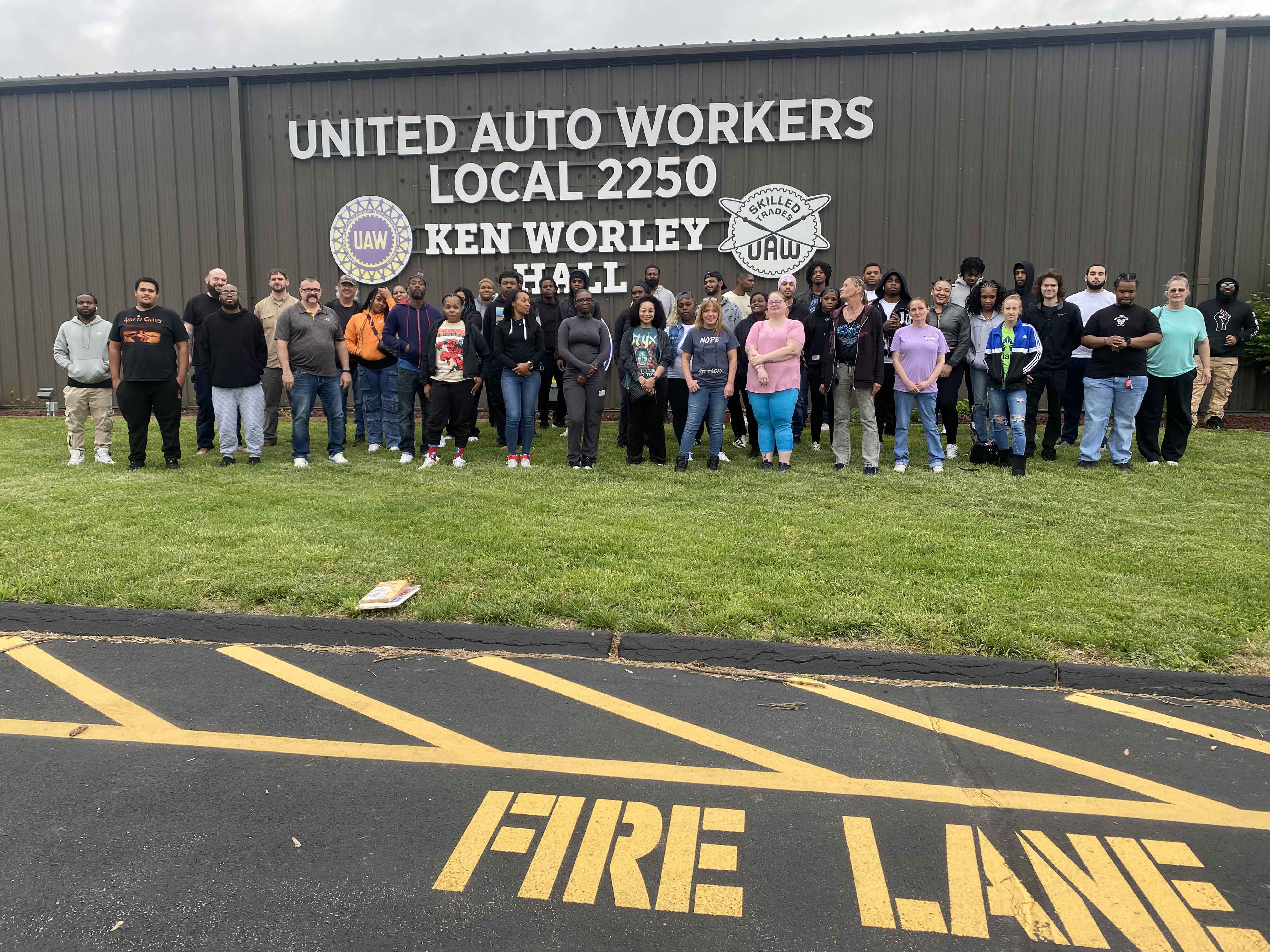

Please Say Hello To The 11 New Members Of Local 2250! - May 8, 2025

-

Point/Counterpoint: Should The Van Be Updated? - May 8, 2025

-

Your Newsline: Money Matters, New Members, Paid Leave Law - May 8, 2025

-

The Weekly Missouri Labor Report - May 5, 2025

-

Sunday Point/Counterpoint: Buying American - May 4, 2025

-

Say Hello to 51 new UAW Local 2250 members! - April 30, 2025

-

R4 Director Campbell and AD DeSpain Talk Tariffs, Politics, and More - April 30, 2025

-

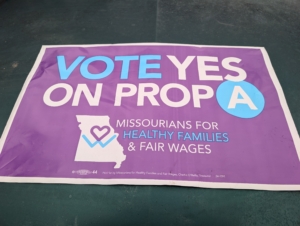

Paid Leave: The Courts Stand With Voters, Will Republican Senators? - April 30, 2025

CEO Says Work Longer, Union Leaders Clap Back!

Yahoo Finance stirred things up last week by featuring an interview with billionaire Larry FInk “America’s retirement age of 65 is “crazy” Blackrock CEO says…

With Americans living longer and spending more years in retirement, the nation’s changing demographics are “putting the U.S. retirement system under immense strain,” according to BlackRock CEO Larry Fink in his annual shareholder letter.

One way to fix it, he suggests, is for Americans to consider working longer before they head into retirement.

Albert Einstein said “every action generates a reaction”. The idea of forcing Americans to work longer before retiring generated a reaction from union leaders Randi Weingarten and Damon Silvers, They penned their response in Forbes – Larry Fink is right about the retirement crisis Anericans are facing – but he can’t tell the truth about the failure of the 401k revolution.

Fink says that Social Security is in crisis because life expectancy is rising. That isn’t true either: Not only is life expectancy not rising for most Americans, but the reforms to Social Security put in place in 1983 would have fully funded Social Security–if there hadn’t been exploding income inequality so that working people’s income stopped growing with the economy and instead income growth went to the top 1%, who don’t pay social security taxes on most of their income.

Even so, the shortfall facing Social Security in the mid-2030s can be easily addressed with enough political will. For example, by making the income of millionaires and billionaires subject to Social Security tax–a simple change that could address as much as 90% of the shortfall.

The union leaders conclude their article with:

Retirement for the working people who do the hard work of our country does not need rethinking. It needs to be honored and funded.

If your interested in taking an in-depth look at retirement in America, Kiplinger features David Cay Johnston and What’s Going on with Social Security, and how concerned should you be?

Miriam Alexander, who runs a small qualitative data analytics firm in Los Angeles, worries that even if Congress does act, it may choose to cut benefits. She worries less about herself than about low-paid workers. She worries lawmakers may loot Social Security under the guise of reform.

“There’s a bunch of money-grubbing, selfish people who don’t see the value of living in a society where we care for each other,” the businesswoman says.

( image via ssa.gov)