-

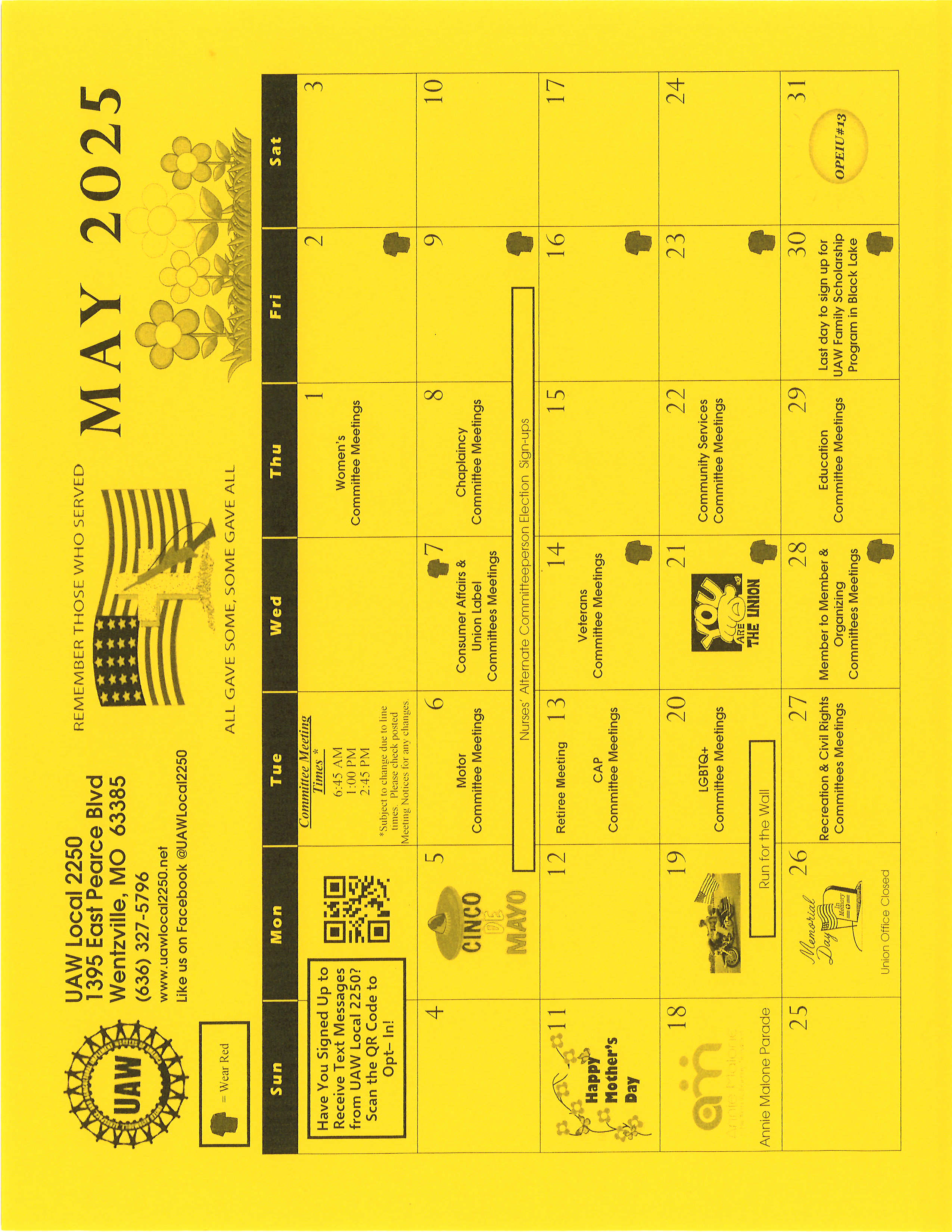

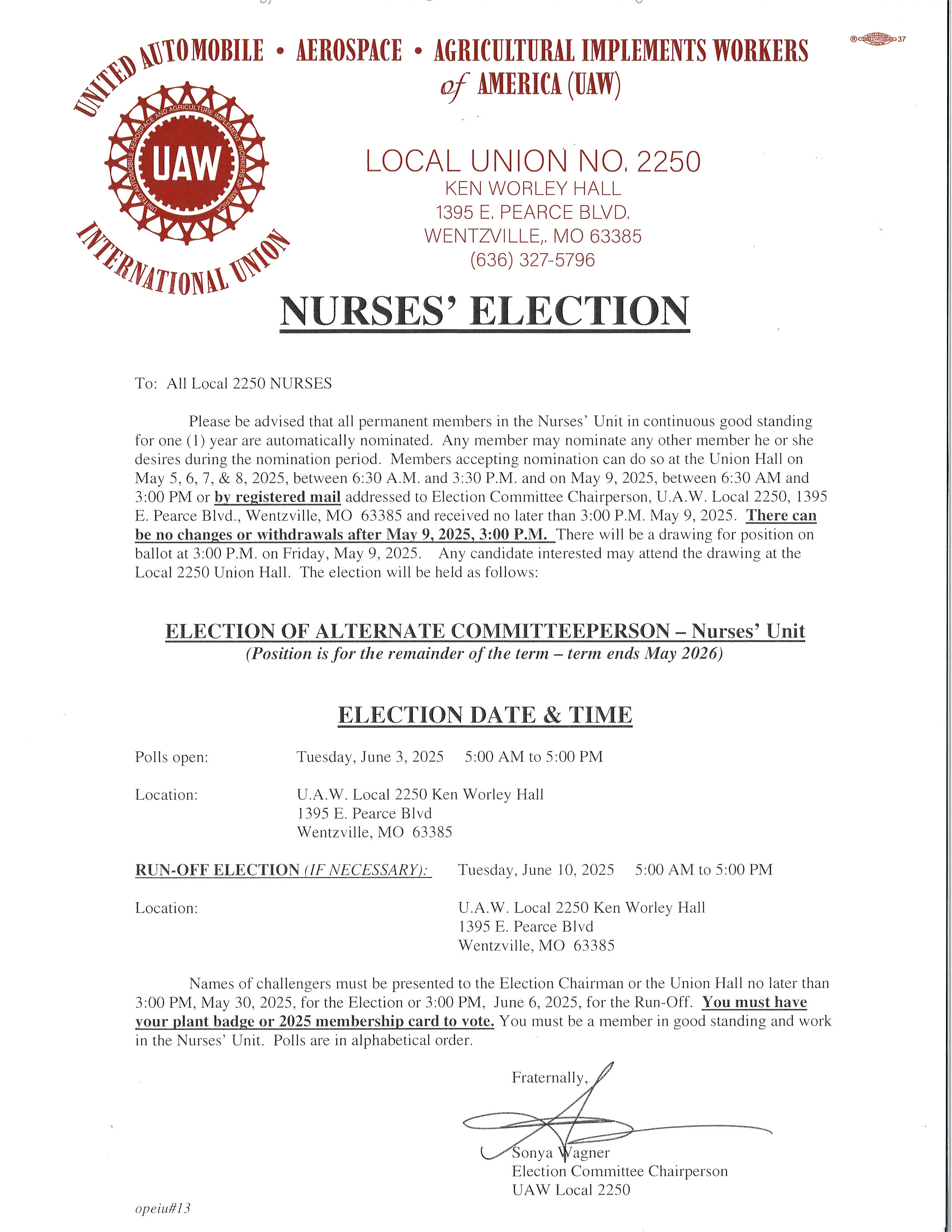

Nurses’ Election Notice: Congratulations Dave! - 17 hours ago

-

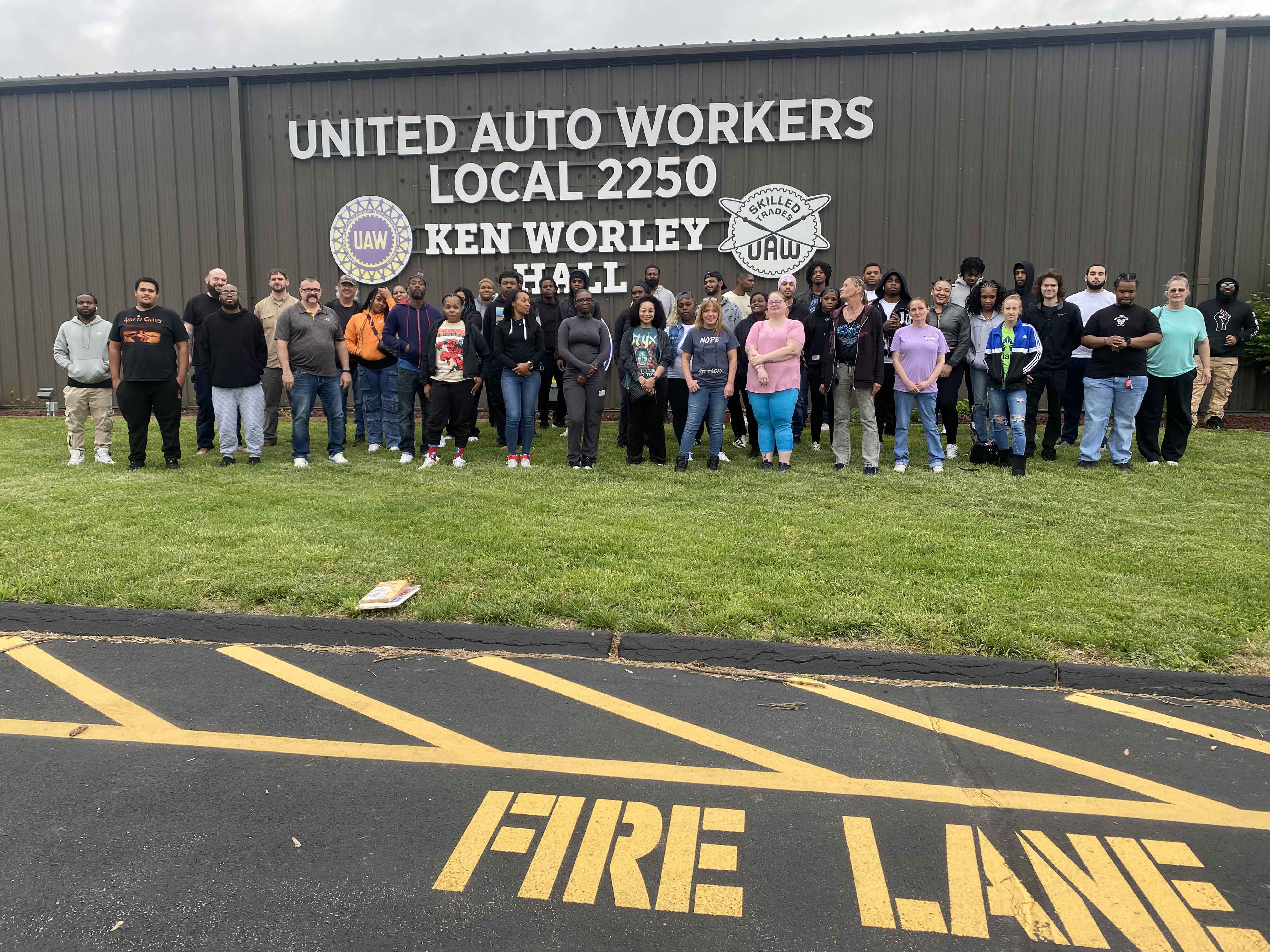

Please Say Hello To The 11 New Members Of Local 2250! - 2 days ago

-

Point/Counterpoint: Should The Van Be Updated? - 2 days ago

-

Your Newsline: Money Matters, New Members, Paid Leave Law - May 8, 2025

-

The Weekly Missouri Labor Report - May 5, 2025

-

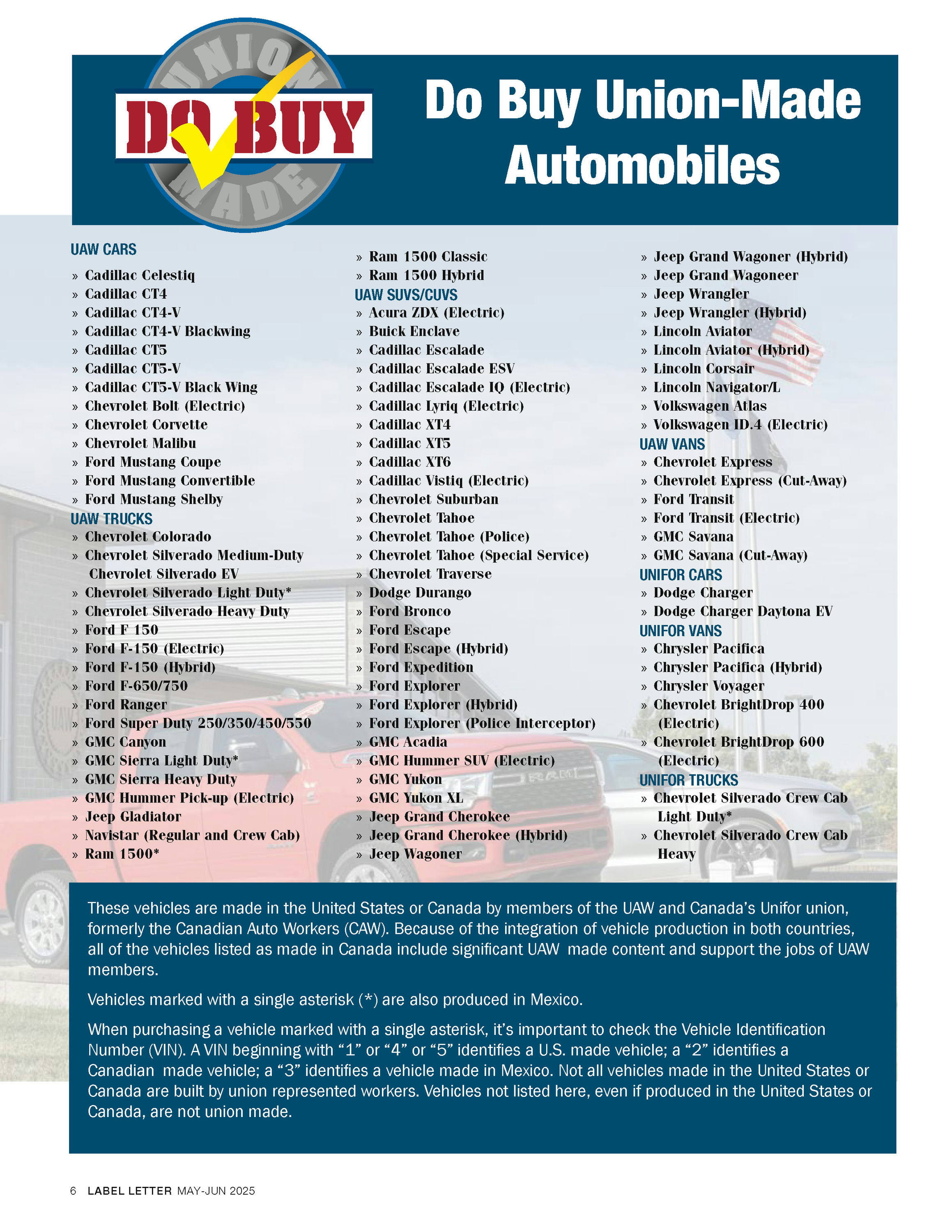

Sunday Point/Counterpoint: Buying American - May 4, 2025

-

Say Hello to 51 new UAW Local 2250 members! - April 30, 2025

-

R4 Director Campbell and AD DeSpain Talk Tariffs, Politics, and More - April 30, 2025

-

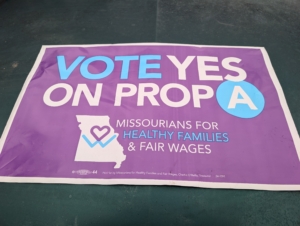

Paid Leave: The Courts Stand With Voters, Will Republican Senators? - April 30, 2025

-

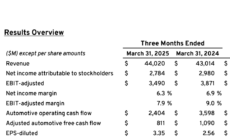

2025 Q1: Here’s What Profit Sharing Looks Like To Start The Year - April 29, 2025

Mo Wage Cuts and Tax Cuts – Who Gets Them?

Your voter approved Paid Leave and Minimum Wage law is being attacked. The law was endorsed by the UAW. At the same time the Missouri legislature is passing a tax cut for the wealthiest Missourians. Wage Cuts for Thee, Tax Cuts for Me should be the theme of the Missouri Chamber of Commerce…

State Rep. David Tyson Smith, a Columbia Democrat, complained that the inclusion of the corporate and capital gains tax cuts focuses too much of the legislation on the wealthy — and does so while potentially putting the state’s budget at risk.

“Everyone appreciates a tax cut,” he said. “But why do we have to slide in tax cuts for the rich?”

Even a Republican has concerns.

“It’s just very skewed to the most wealthy people,” state Sen. Mike Cierpiot, a Lee’s Summit Republican, said of the capital gains bill. “The 8,000 wealthiest families (in Missouri) will get more than half of the benefit.”

KY3 is reporting that the Missouri Supreme Court weighs whether to overturn new paid sick leave and minimum wage requirements passed by voters in November…

“They present zero evidence that any of the claim bearers had any effect on the election, let alone an outcome-determinative effect,” said Loretta Haggard, a lawyer for the defendants. However, the Missouri Chamber of Commerce and Industry has a contingency plan for its

However, the Missouri Chamber of Commerce and Industry has a contingency plan for its fight against Prop A. A bill that would stop the paid sick leave part of Prop A from going into effect needs only one more vote to pass out of the Missouri House.

If you are tired of wage cuts for working Missourians and tax cuts for the rich you can find your State Representative t share your feelings here – https://house.mo.gov/

Your State Senator can be found here – https://www.senate.mo.gov/legislookup/default