-

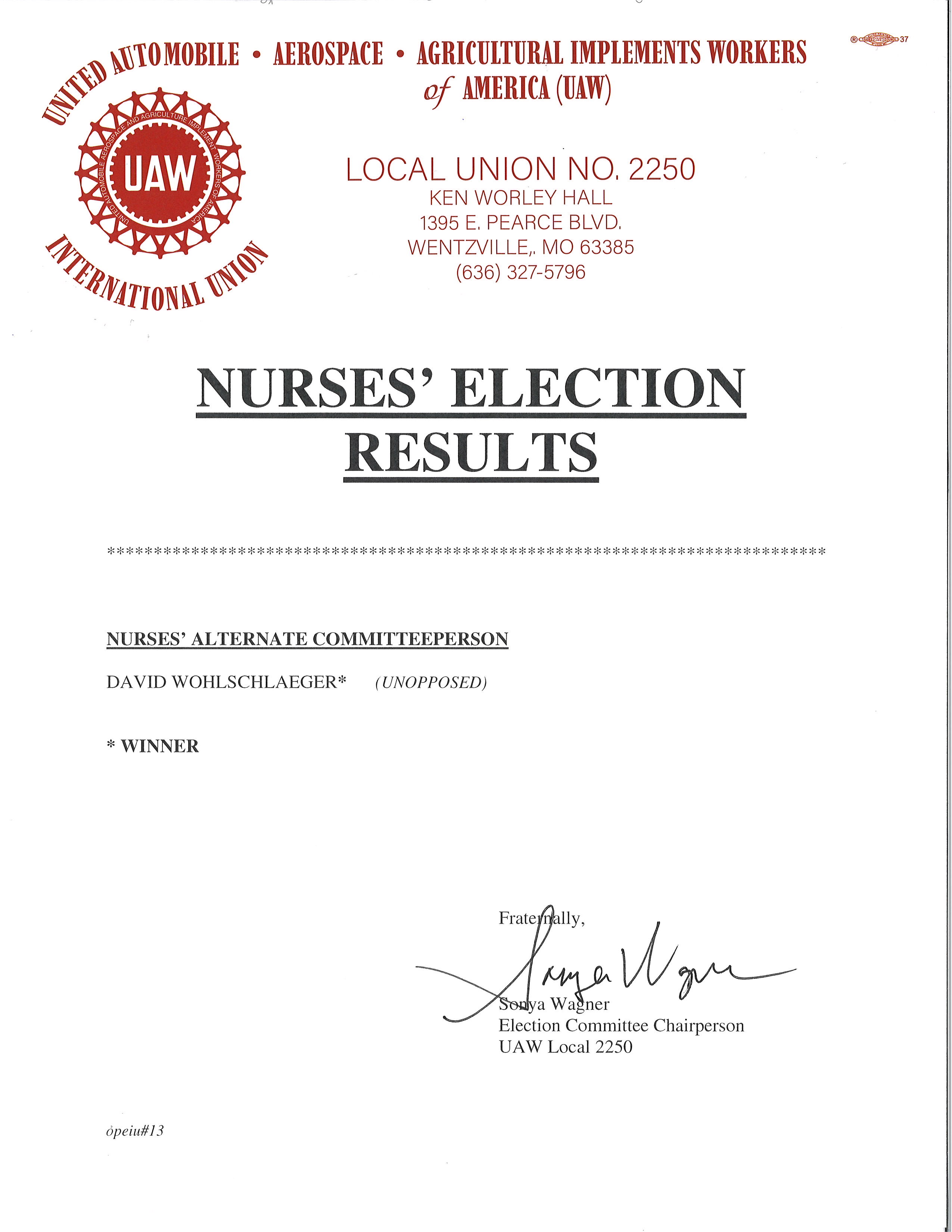

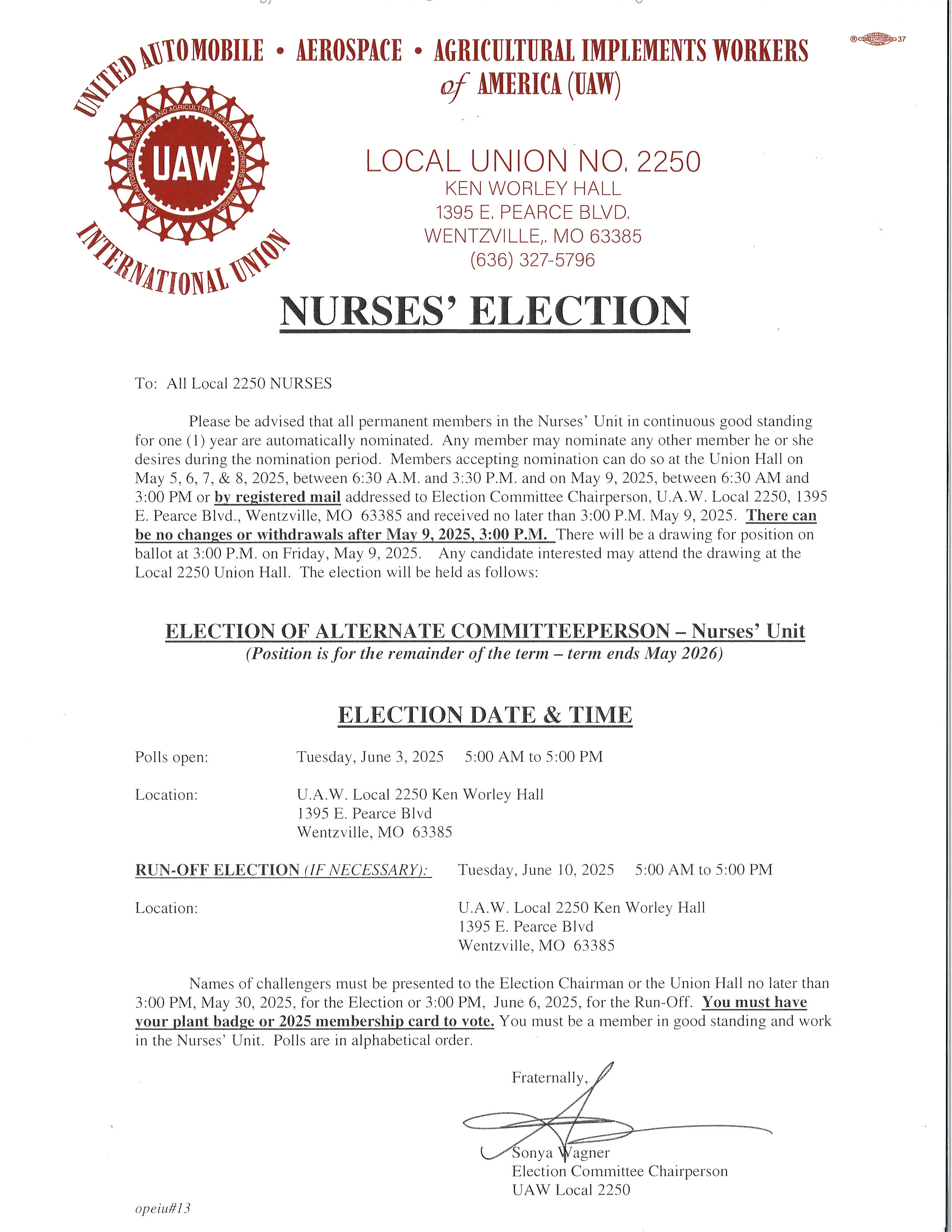

Nurses’ Election Notice: Congratulations Dave! - 3 hours ago

-

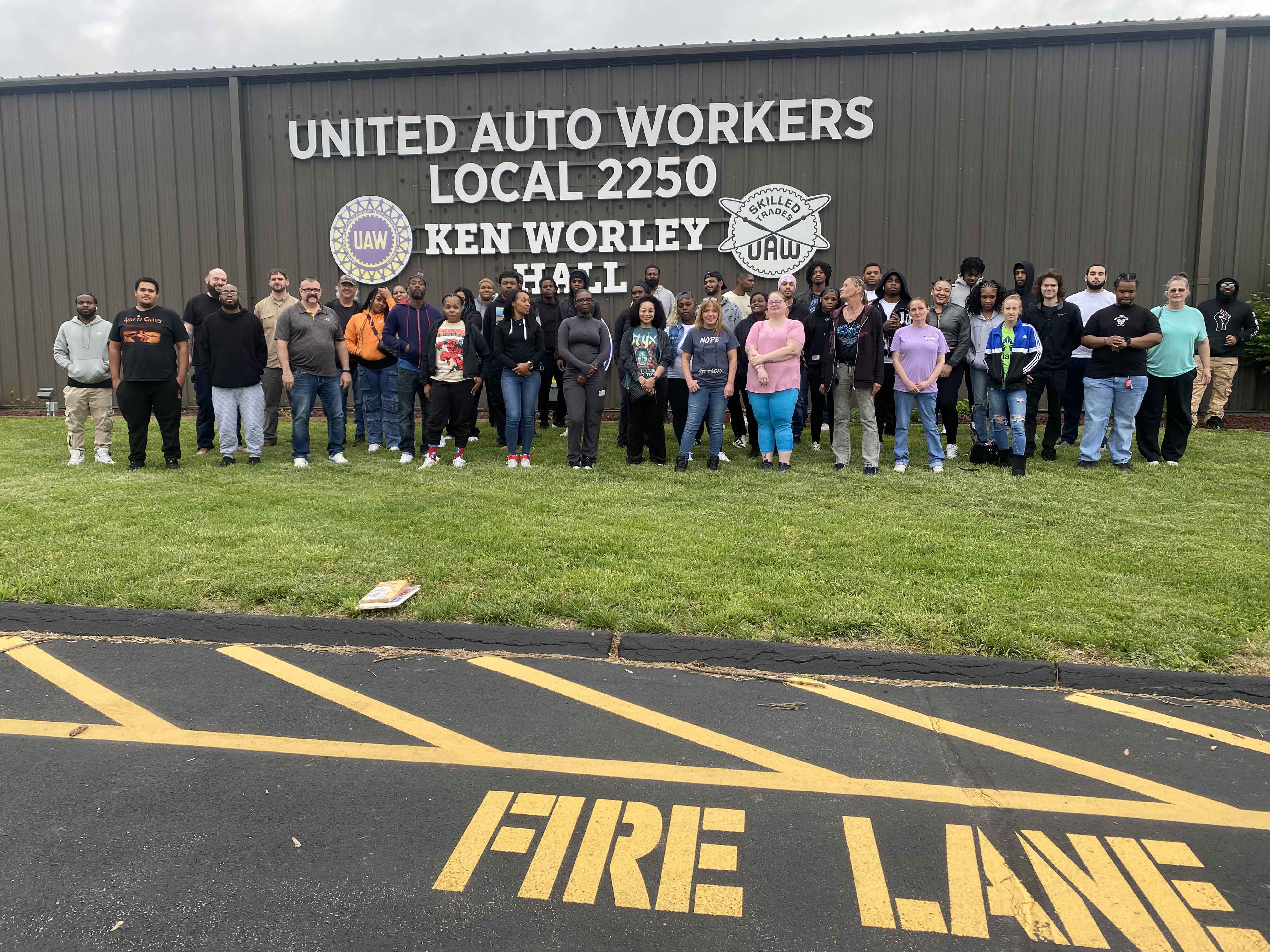

Please Say Hello To The 11 New Members Of Local 2250! - 24 hours ago

-

Point/Counterpoint: Should The Van Be Updated? - 1 day ago

-

Your Newsline: Money Matters, New Members, Paid Leave Law - 1 day ago

-

The Weekly Missouri Labor Report - May 5, 2025

-

Sunday Point/Counterpoint: Buying American - May 4, 2025

-

Say Hello to 51 new UAW Local 2250 members! - April 30, 2025

-

R4 Director Campbell and AD DeSpain Talk Tariffs, Politics, and More - April 30, 2025

-

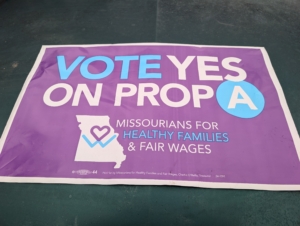

Paid Leave: The Courts Stand With Voters, Will Republican Senators? - April 30, 2025

-

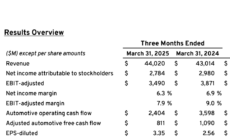

2025 Q1: Here’s What Profit Sharing Looks Like To Start The Year - April 29, 2025

PTWO: Is This The Tier 2/In Progression Retirement Plan?

Is This the Tier 2/In Progression Retirement Plan?

Darin Gilley

UAW Local 2250

PTWO (Part-Time on the Way Out)

This summer has seen us say goodbye to many of our friends and co-workers as these pension-eligible, Traditional brothers and sisters take advantage of the Special Attrition Program or SAP. The SAP provides a $50,000 incentive for these well-deserving union members to retire and begin the next chapter of their lives. Their years of hard work and dedication will be recognized as they begin to collect their pensions and retirement health care benefits detailed in the collective bargaining agreement between GM and the UAW. The agreement specifies that more Traditional members will have the opportunity to access the SAP over the next three and a half years.

What About Tier 2/In Progression Members?

Is there a plan for T2/In Progression members to transition from active to retired status? Should there be?

It has been sixteen years since the collapse of the auto industry and the crisis that required the American people to help both Chrysler and GM. Bridge loans from the government to these companies allowed them to recover and saved thousands of jobs while they returned to profitability.

The SAP and its retirement incentives are only available to hourly workers hired before the auto crisis. In response to the crisis, workers hired after the crisis are not eligible for a defined-benefit pension or retiree health care. In the last sixteen years, thousands of folks have been hired and are working for the Big 3 automakers. Some of these autoworkers are already at the half-way mark of what would have been pension eligibility at thirty years of service. Considering it took fifteen years to resolve the unfair system of Tier 2 wages the time is now to consider retirement options for these members.

The 2023 national agreement does not include either pension or retiree healthcare for T2/In Progression members. It did increase the company contribution to members 401k from 6.4% to 10%. This was a solid accomplishment that puts us in the top two percent of defined contribution plans in the country. However, the cost and expense of a traditional pension that were factors in the latest negotiations are going to be challenges going forward. If a return to pensions and retiree healthcare are not on the table, what can be done?

PTWO (Part-Time on the Way Out)

Without a pension or retiree health care the post-bankruptcy generation of autoworkers face a retirement that is much different than Traditional autoworkers.

According to a 2024 MassMutual survey the average age of retirement in America is 62. Unfortunately, this is three years before folks are eligible for Medicare (65) and five years before the current eligibility age for Social Security (67). Why is the average age to begin retirement sixty-two? There are many factors, but personal health is one of the primary reasons. Their bodies can no longer meet the 5-6 days a week demands of their occupation. Former UAW President Walter Reuther summed up this human condition with the phrase “too old to work – too young to die.” That slogan was the rallying cry that led to the thirty and out pension.

Autoworkers face a combination of excessive overtime, extended periods of standing on concrete floors, repetitive motion, and other hazards that make it physically difficult to work until age 67 or even 65. Without the protection of a thirty – year pension, this leaves T2/In Progression workers outside the legislative safety net of Social Security and Medicare for a number of years.

CNN reports that the median 401k balance for a 62-year-old American is $87,591. Divide that figure by a 20-year retirement and the annual distribution would be $4.379. Would you feel comfortable with that amount? Particularly, if you had to purchase a health insurance policy until reaching Medicare.

What if a PTWO program could give the company the ability to retain important skills and institutional knowledge? This program would allow T2/IP members to scale back their hours, while keeping their current pay and benefits. A PTWO program would put in practice a movement that has gained momentum throughout the world of labor relations. A planned transition from active to part-time to retirement helps both the company and the members. This program would work in combination with both a pension/401k and retiree healthcare program if these benefits are negotiated.

The next national agreement is over three years from now. A successful PTWO program will have to deal with numerous factors. Fortunately, there are many talented members that have the ideas and experience to create a unique and sustainable program. Let’s put our work boots on and create something new. A program that can provide a runway for members without a pension to retire with dignity.

(graphic by Ciker-Free Vector @ Pixabay)