-

A New Pope (From America): More Support For Worker Rights! - 2 days ago

-

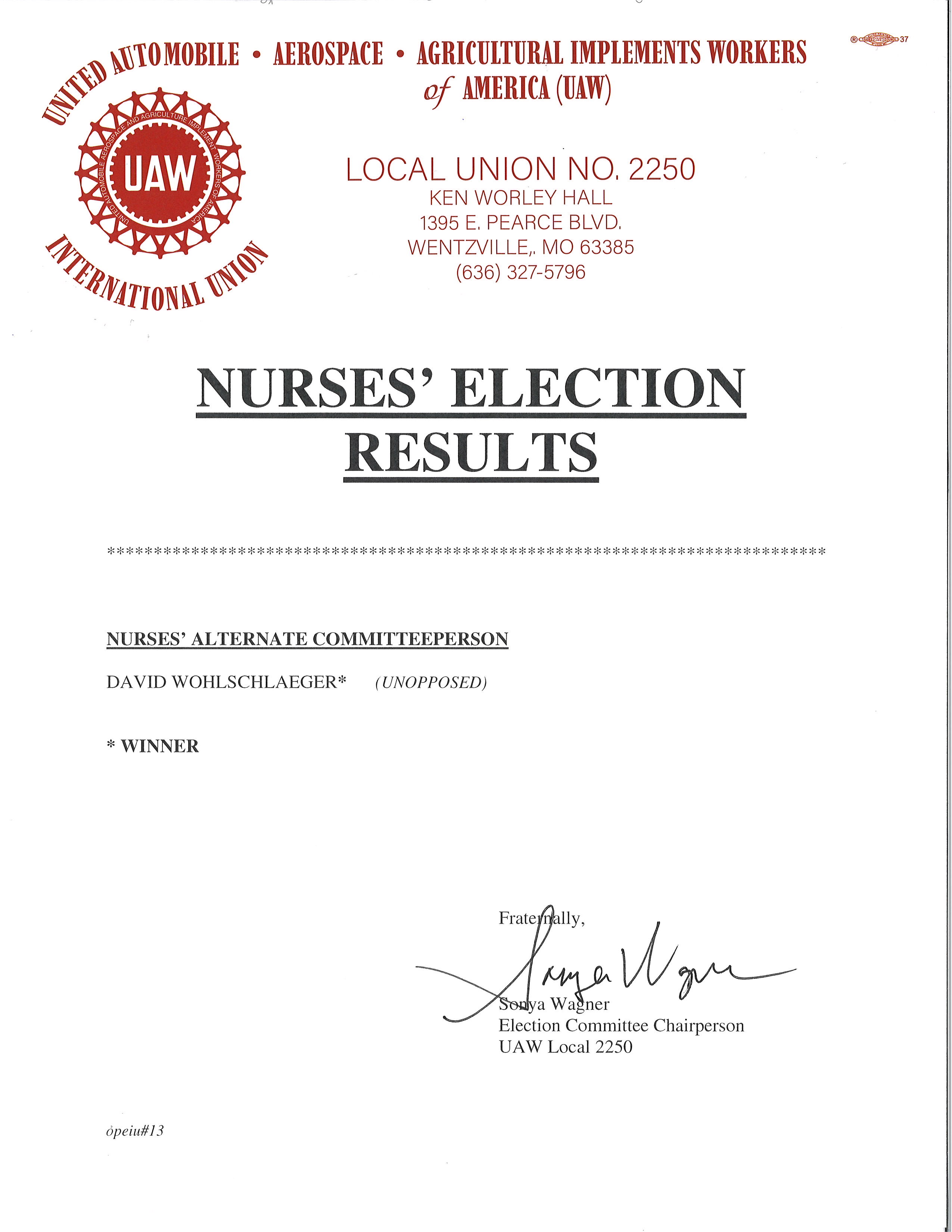

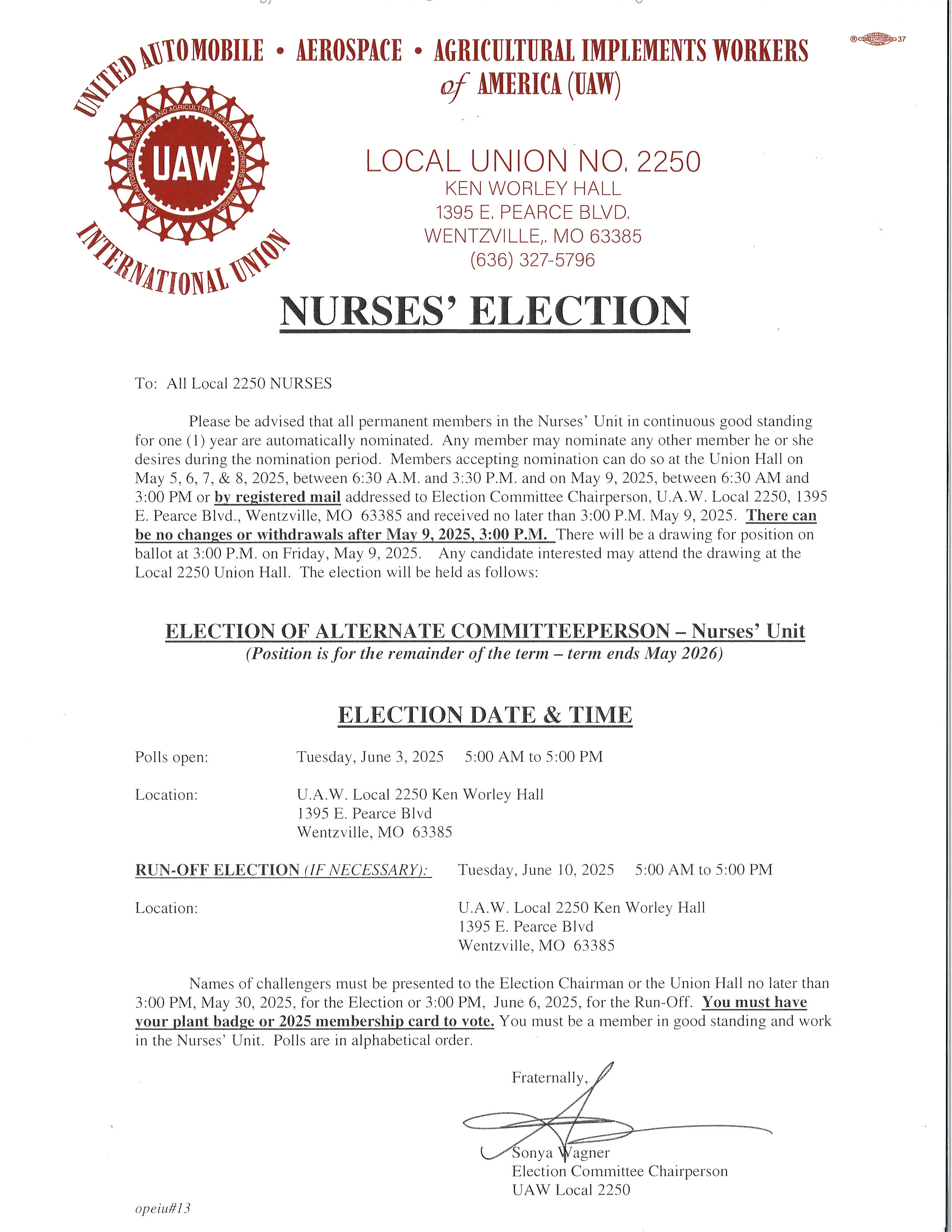

Nurses’ Election Notice: Congratulations Dave! - May 9, 2025

-

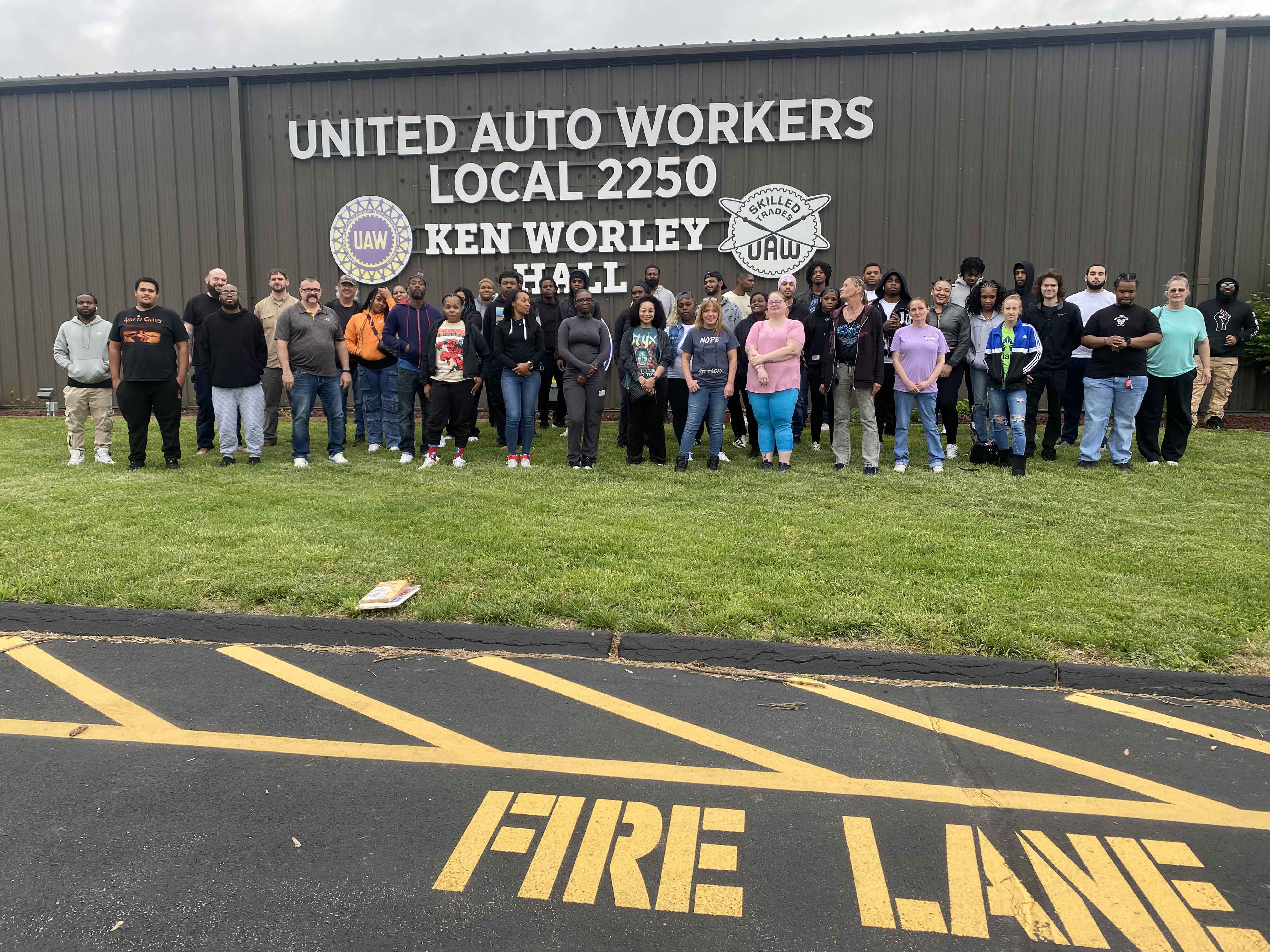

Please Say Hello To The 11 New Members Of Local 2250! - May 8, 2025

-

Point/Counterpoint: Should The Van Be Updated? - May 8, 2025

-

Your Newsline: Money Matters, New Members, Paid Leave Law - May 8, 2025

-

The Weekly Missouri Labor Report - May 5, 2025

-

Sunday Point/Counterpoint: Buying American - May 4, 2025

-

Say Hello to 51 new UAW Local 2250 members! - April 30, 2025

-

R4 Director Campbell and AD DeSpain Talk Tariffs, Politics, and More - April 30, 2025

-

Paid Leave: The Courts Stand With Voters, Will Republican Senators? - April 30, 2025

Hurt At Work? You Have Rights!

When extra hours are worked there is an increased chance of a work-related injury. Workers Compensation is a state law designed to help folks injured at work. Attorney Michael Goldberg has shared this look at your rights if an injury occurs at work.

Where’s My Workers’ Compensation Payment?

When you’re injured on the job, the expectation is that workers’ compensation will replace

wages lost while off work. But over the past ten years or so, injured workers have begun

experiencing delays, sometimes substantial, in receiving the benefits they’re entitled to. And not

being paid in a timely manner can cause substantial hardship for injured workers and their

families.

These days, I spend way too much time chasing down information about worker

nonpayment and contacting attorneys representing the companies just to get workers’

compensation insurance companies to pay the benefits they’re supposed to pay!

Occasionally, it’s a worker who’s confused about payments. So, while I can’t magically make the

insurance companies pay on time, I can educate you, the worker, about workers’ compensation

so you understand how the system is supposed to work.

What and When You’ll Be Paid

When you’re off work for a work-related injury, you’re supposed to receive two-thirds of your

salary based on the last 13 weeks you worked prior to the date of injury. The two-thirds amount

should be based on your gross pay for the 13 weeks. In addition, weeks that you didn’t work or

worked few hours shouldn’t be used in the calculation. However, some insurance

companies—almost routinely—use the wrong calculations.

To receive payment through workers’ compensation, you must be off work because of a workers’

compensation doctor’s opinion. The doctor can require you to be off work completely or give

you such significant restrictions that the employer is unable to place you on the job using

modified duty. You will not be paid for the first three days unless you’re off work for more than

two weeks. If you’re off longer than the two-week time limit, you’re entitled to your workers

compensation pay for those first three days.

The proper time limit for payment should be the same as your regular pay period. It should never

exceed a two-week period.

Workers’ Compensation versus Disability

Sometimes issues crop up because a worker may be receiving disability payments in addition to

workers’ compensation. You can’t receive full disability benefits and workers’ compensation

payments since you’d be double dipping on the benefits. You can’t be paid more money when

you’re injured and off work than you get in your regular job! If this type of overpayment occurs,

the excess money will be taken back. To avoid you having to repay money you shouldn’t have

received, offsets and wrong amounts are verified on every claim. This is done by reviewing your

wage statement to verify your wages and double check the workers’ compensation calculations

and confirm if and for what amount disability payments are being made.

If a problem with disability payments occurs, the employee is the only person who can talk to the

disability plan. Disability, which is based on your union contract, is separate from workers’

compensation. Legally, I can only talk with the attorney on the other side managing the workers’

compensation claim. Even though workers’ compensation and disability departments may be

within the same insurance company, they often don’t communicate with one another, which is

why problems can occur. Fortunately, this problem occurs less frequently than nonpayment of

workers’ compensation.

Correcting Nonpayment of Workers’ Compensation Benefits

There are two remedies for nonpayment or not timely payment of workers’ compensation

benefits. 1) I call and email the other side constantly to get relief for my client. 2) File a hardship

petition in court to get the issue in front of a judge.

I’m happy to be considered an annoyance to the other attorney if it means you get the benefits

you are entitled to. I never want my clients to be in a crisis because some faceless insurance

company decided not to pay them that week. So, I call and email repeatedly until I get an answer

that helps my client.

Filing a petition is a longer-term solution that is necessary in the most egregious cases. It’s never

my first option, because I’d rather solve the problem without taking this drastic step. But I won’t

shy away from doing what’s right for my client either. If a hardship petition is needed, it gets

filed.

When issues like these arise, you must let your attorney know as soon as possible. The sooner I

know of these types of problems, I can start fixing the situation.

Michael Goldberg is the owner of Michael C. Goldberg Law, L.L.C. His firm focuses on workers’

compensation, civil litigation, and labor law. Mike’s also a member of CWA Local 6300. Contact

him at (314) 824-0350, mike@michaelgoldberglaw.com, or visit his website at

michaelgoldberglaw.com.

(Image via Adobe Stock)