-

Are You The Reason Cars Are So Expensive? NO! - 9 hours ago

-

A New Pope (From America): More Support For Worker Rights! - May 11, 2025

-

Nurses’ Election Notice: Congratulations Dave! - May 9, 2025

-

Please Say Hello To The 11 New Members Of Local 2250! - May 8, 2025

-

Point/Counterpoint: Should The Van Be Updated? - May 8, 2025

-

Your Newsline: Money Matters, New Members, Paid Leave Law - May 8, 2025

-

The Weekly Missouri Labor Report - May 5, 2025

-

Sunday Point/Counterpoint: Buying American - May 4, 2025

-

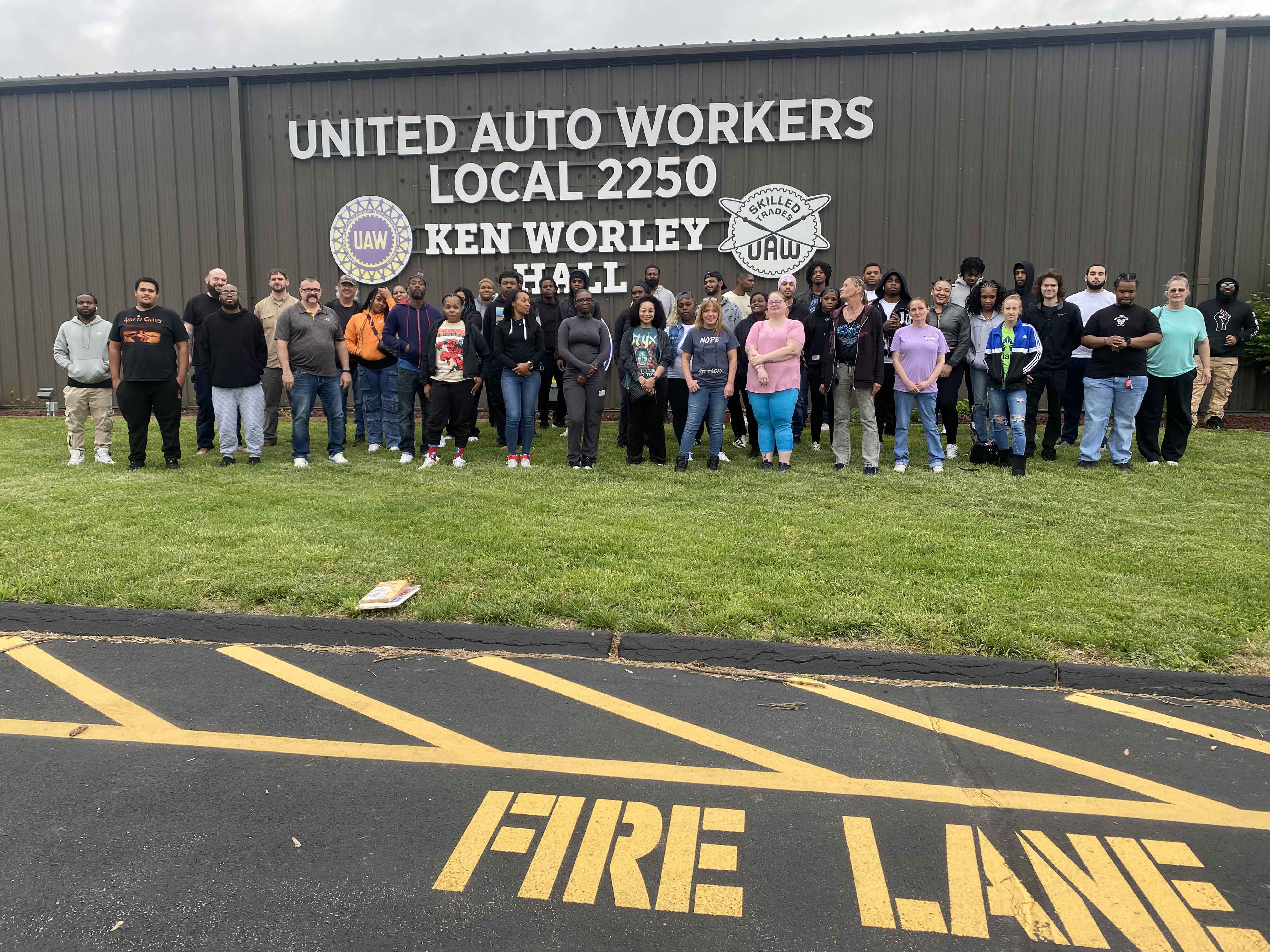

Say Hello to 51 new UAW Local 2250 members! - April 30, 2025

-

R4 Director Campbell and AD DeSpain Talk Tariffs, Politics, and More - April 30, 2025

Automakers Could Forgo Stock Buybacks To Pay For Union Demands

Sure, they were illegal until the 80’s but they have made our economy more unequal ever since. It seems like we would never read this headline but Markets Insider brings us UAW Strike: Automakers Could Forgo Stock Buybacks To Pay For Union Demands…

- Auto companies could forgo stock buybacks to pay for the costly union demands, an analyst said.

- Strikers have pointed out the billions of dollars companies have poured towards buybacks and dividends.

- Some investors have expressed willingness to sacrifice stock repurchases.

Looks like the UAW Bargaining team may be on to something. Just for fun let’s flashback to an article I wrote almost a decade ago. Enjoy!

GM Hourly Workers to Pay Millionaire’s

Darin Gilley

USA Today is reporting that General Motors will pay a dividend of 30 cents a share.

Despite being saddled with costs of its recalls, General Motors is keeping up with its shareholder dividends.

The automaker just declared a 30-cent-a-share dividend on common stock for the third quarter, same as in the past two quarters. The dividend is payable to shareholders of record on Sept. 26 as of Sept. 10.

Unlike past quarters, however, GM is mired in the process of settling claims of deaths and injuries from crashes involving vehicles with its ignition switches on smaller cars. It also has had more than 60 recalls of vehicles for all sorts of problems so far this year involving more than 26 million vehicles.

Even as the auto industry rides high as whole, GM reported net income of only $200 million in the second quarter because of a $1.2 billion charge for the cost of recalls. A year ago, it made $1.2 billion — and had only $100 million in recall expenses.

Once again, the media ignores some important aspects of this dividend pay-out. This story features four groups associated with General Motors.

- Victims of defective ignition switches: According to the story these victims will receive between $400 – $600 million in compensation.

- GM Executives, Management, Engineers: Responsible for defects.

- GM Shareholders: Did not cause defects or recalls but will receive a reward of 30 cents a share in dividends

- GM Hourly Employees: Did not cause defects or recalls but will experience a pay cut due to reduced profit-sharing.

GM Can Afford To Pay Folks That Make Money From The Product

This dividend is equivalent to a 3% pay-out from GM to shareholders as reported by StreetInsider…

The annual yield on the dividend is 3 percent.

“Today’s General Motors is designing high-quality, world-class vehicles for our customers and delivering consistently solid financial results,” said Dan Akerson, GM chairman and CEO. “The board understands that our investors should share in this success and is pleased to announce a quarterly dividend for our common stockholders.”

According to Dan Ammann, GM executive vice president and chief financial officer: “Our fortress balance sheet, substantial liquidity, consistent earnings and strong cash flow provide the foundation for an ongoing payout. This return to shareholders is consistent with our capital priorities and is an important signal of confidence in our plans for a continuing profitable future.” Ammann will become GM President effective Wednesday (Jan. 15, 2014).

Through the third quarter of 2013, GM achieved 15 straight profitable quarters in which it generated $16.3 billion in adjusted automotive free cash flow. As of Sept. 30, 2013, the company had total automotive liquidity of $37.3 billion and $8.4 billion of automotive debt.

GM Can Afford To Pay Those That Build The Product, But Will They?

While sending an important signal to shareholders about company profitability there is no signal to hourly workers that building the product is as important as paying folks that let their money earn money.

Currently GM is paying a Tier 2 employee with benefits after probation 3.1% of product cost.

If workers were paid full scale with Tier 2 benefits (no retiree healthcare or defined benefit pension) they would be paid 4.5% of product cost.

President Abraham Lincoln stated that “Labor is superior to Capital and deserves much higher consideration.” With hourly workers, who spend their lives building the products that make GM one of the largest automakers in the world, having their profit-sharing pay cut in order to finance dividends for folks that let their money earn money it is obvious that Capital is the much higher consideration.

There is no justification for folks that hit the time clock, roll up their sleeves, and build the products the company counts on to be treated in a matter inferior to folks that merely invest their disposable income in the company.

When American taxpayers helped this once great company through a time of crisis it wasn’t just to allow more vehicles to be built, it was to save good middle class jobs.

Honest Abe may be rolling over in his grave but unless Americans want to continue increasing the income inequality problem, now is no time for the rest of us to roll over.

( graphic via freeimages.com)