-

St. Louis Labor Tribune Calls Out Troy Chamber on UAW! - April 27, 2024

-

May Calendar: Aramark Elections, Run For The Wall, and More! - April 25, 2024

-

Welcome The New Hire Class of April 24, 2024! - April 25, 2024

-

Welcome The New Hire Class Of 4/18/2024 - April 25, 2024

-

Welcome New Hire Class of 4/11/2024! - April 23, 2024

-

Welcome New Hire Class of 4/4/2024! - April 23, 2024

-

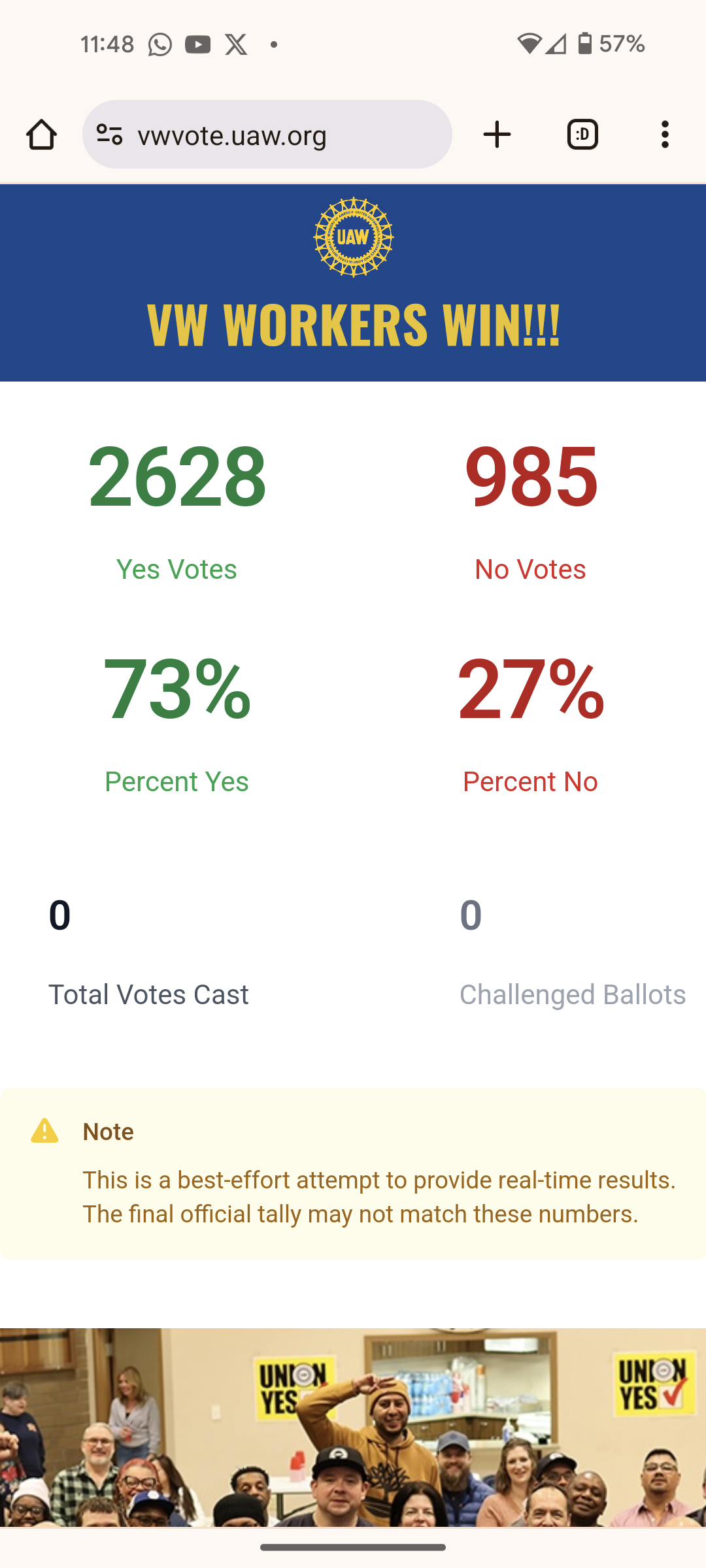

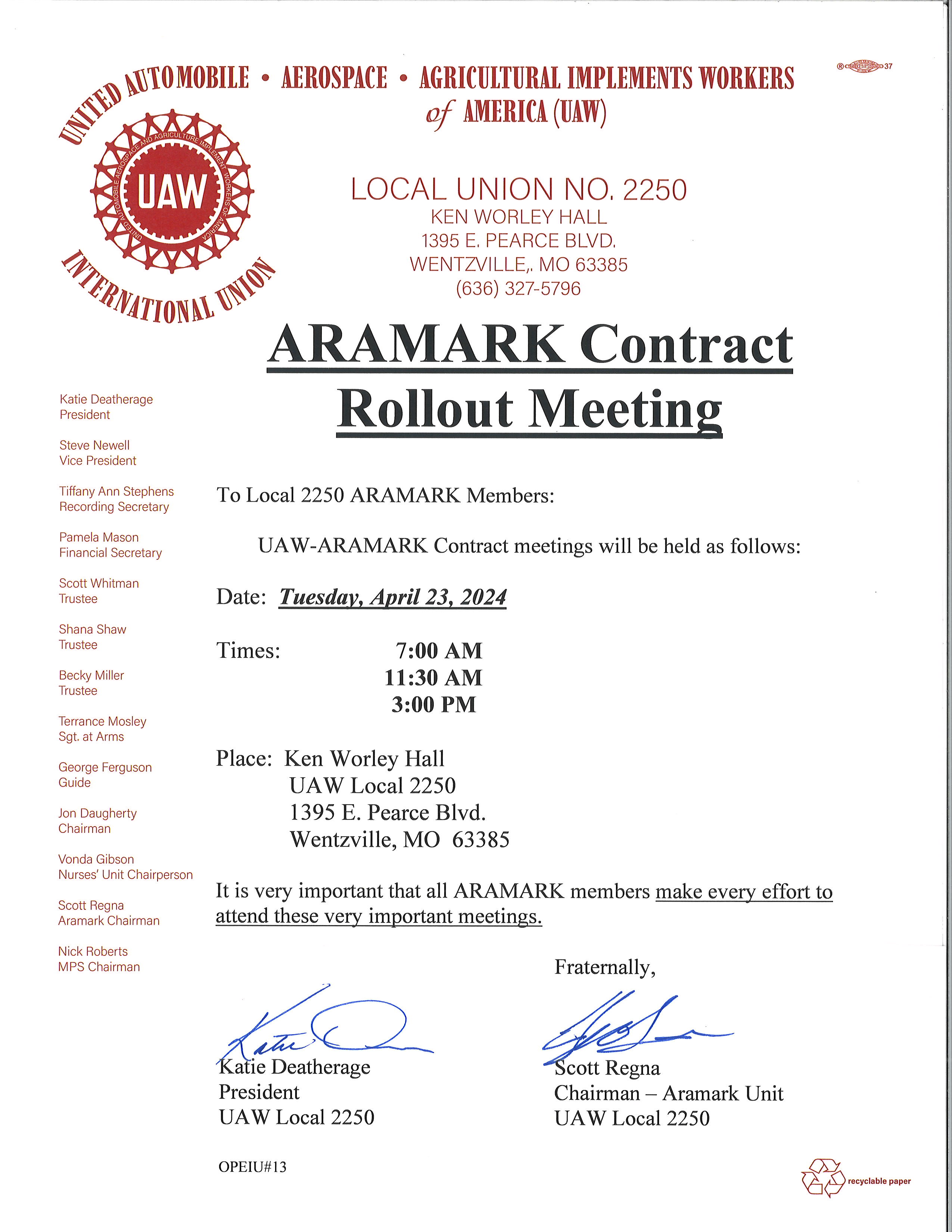

UAW VP Mike Booth: GM Aramark Workers WIN Record Contract - April 23, 2024

-

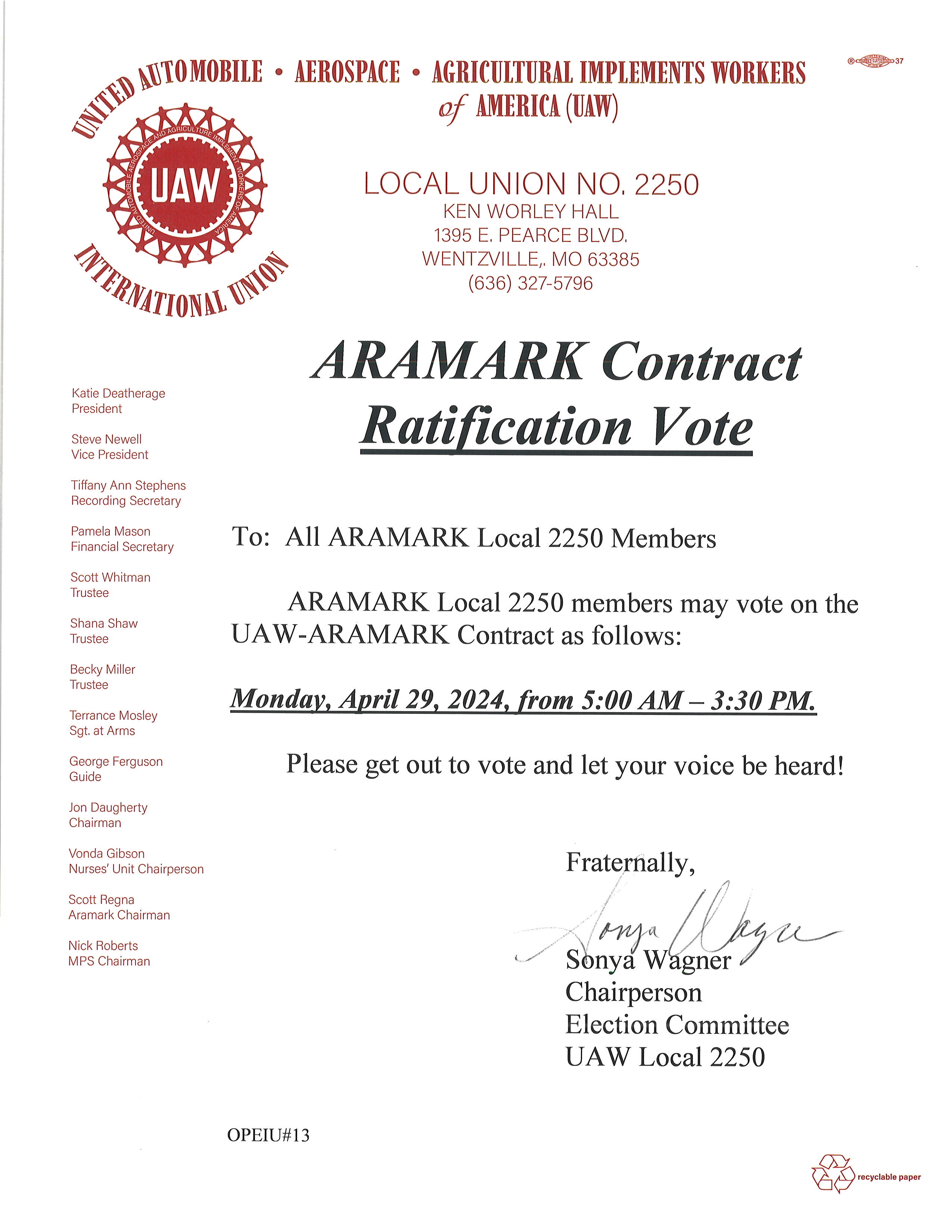

Aramark Contract Vote! - April 22, 2024

-

Elon Tells Workers The Company “Can’t Afford a Pay Raise”, Meanwhile…. - April 22, 2024

-

The IUAW Now Has A Store! - April 21, 2024

Guest Opinion: Corporate Taxes Should Go Up

This week’s guest opinion is from Thom Hartmann @ hartmannreport.com. Stronger businesses, better-paid workers, and less income inequaltiy are all reasons Thom explains in Why the Corporate Tax Bracket Should Go Back to 52%…

These things that derive from a high corporate tax rate all benefit the company, the workers, and the communities where they operate. They make America stronger.

Expanding innovation and product lines makes the companies and the economy more vibrant. They build and strengthen the middle class. They even help the entire nation via the federal and state governments, because companies must show some profits (as they become more successful) to distribute dividends to shareholders and those profits are taxed, producing government revenues.

All those activities mentioned above are tax-deductible. Which shows how important it is to have a high corporate income tax rate because, with the current absurdly low tax rates, companies have little incentive to do anything other than buy back their shares and make their already morbidly rich CEOs and major investors even richer.

Editors note: Prior to the 2015 and 2019 contract cycles, I wtore many articles that detailed hourly worker paychecks at GM and how the company could afford to eliminate the Tier 2 pay scale. This could of been accomplished much faster if the corporate tax rate had been higher and those payroll expenses were used as tax-deductions. Of course, GM came out of the bandruptcy/Great Recession with massive tax credits but that is a discussion for another post. When you hear higher corprate taxes don’t think poor CEO, think better paid workers and stronger companies!

(graphic via freeimages.com)