-

You Can Carry Your UAW/GM Wentzville Local Agreement 24-7-365 - 6 hours ago

-

Did Your Bid Win? - 11 hours ago

-

Shawn Fain, Trump, and Tariffs: What’s The Truth? - 2 days ago

-

Guest Opinion: Lawmakers Shouldn’t Undermine Missouri Voters - March 29, 2025

-

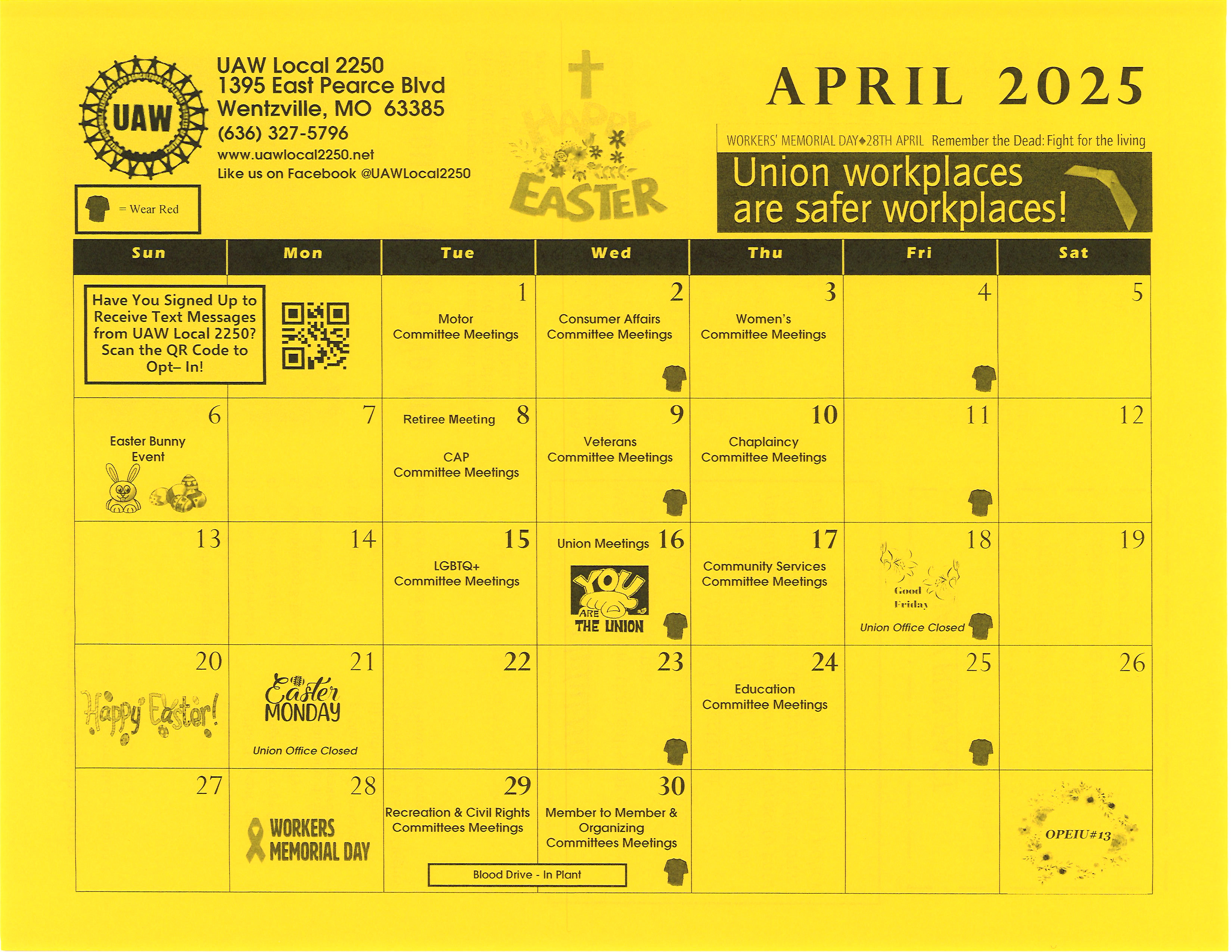

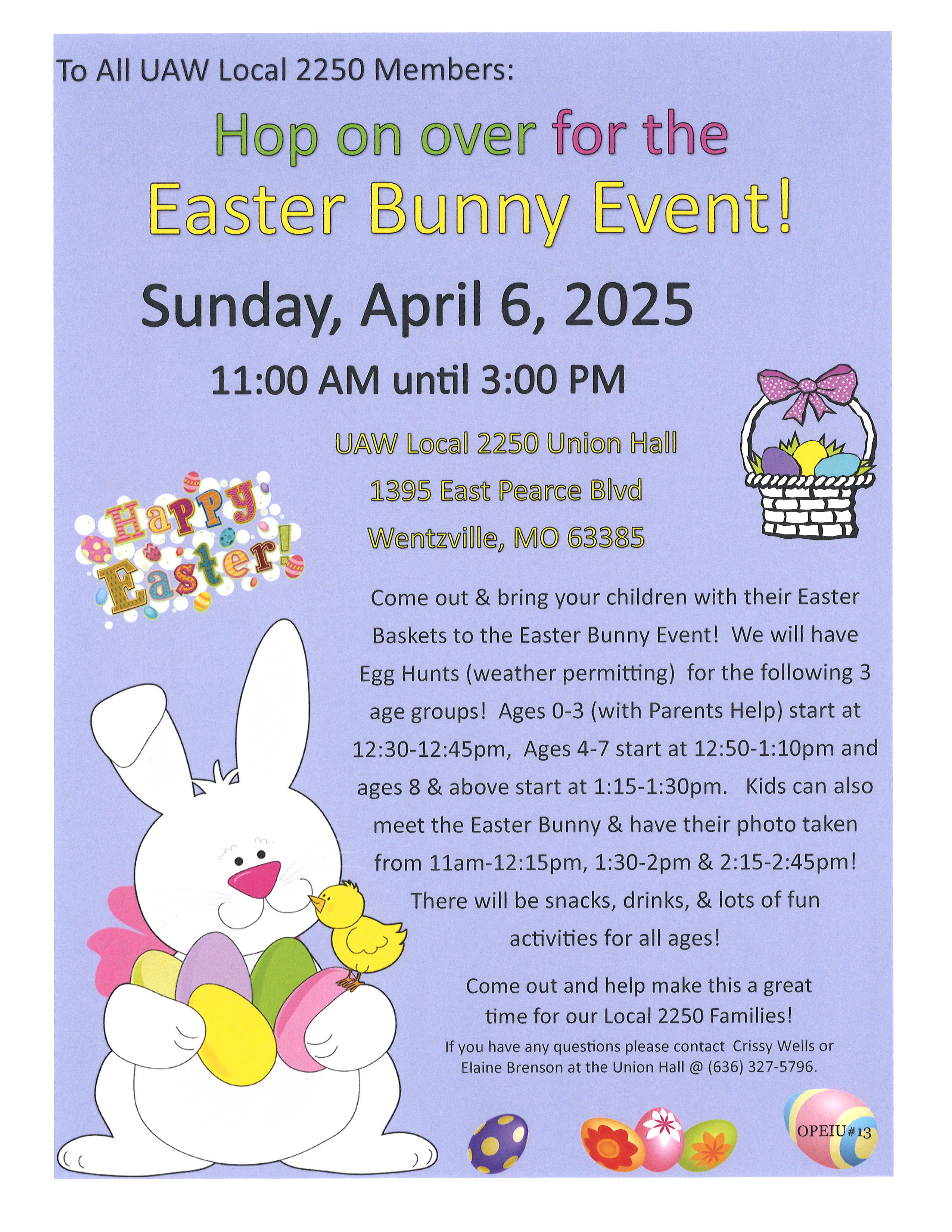

April Showers Bring More Activities! - March 28, 2025

-

The 2025 Missouri AFL-CIO Joint Legislative Report - March 27, 2025

-

P2: Phased Retirement For Tier 2/Progressive Members – A New Trend? - March 23, 2025

-

Sunday Guest Opinion: Education Department Cuts Damage The Working Class - March 22, 2025

-

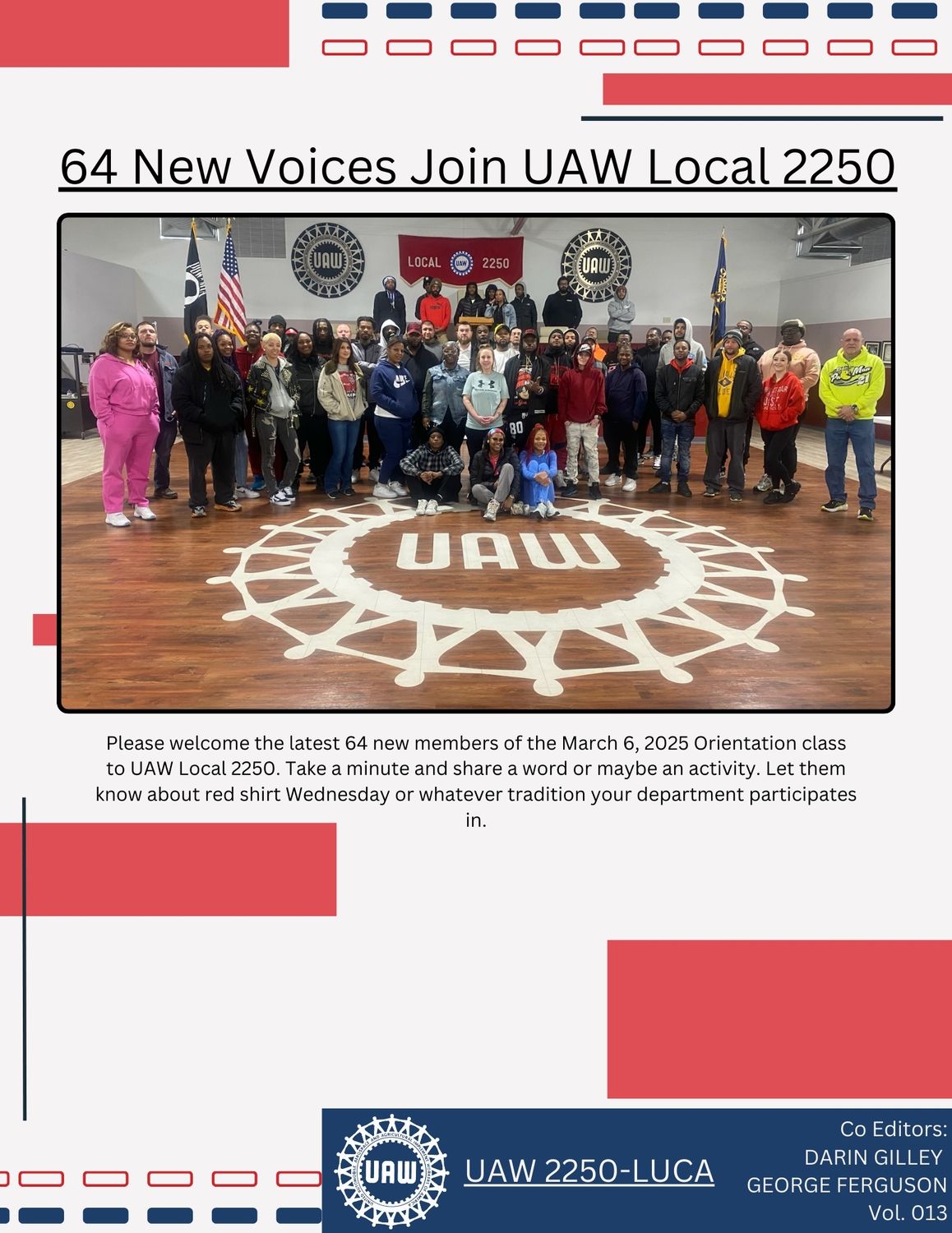

Newsline #13: New Members, Paid Leave, and The State Capitol! - March 21, 2025

-

Check Out The Organizing Committee! - March 21, 2025

Would This Retirement Benefit Keep You At Work?

Would A Retirement Bonus Keep You At Work?

by: Darin Gilley

Like many companies these days GM finds itself having fewer workers than it needs to run at maximum profitability and a solution seems hard to find. At a recent union meeting it was said that we are losing an average of 11 members per week while being able to hire 4-6 per week.

Could it be that the last thirty years of corporate cost cutting focused on eliminating the responsibilities of employer to employee were always going to end this way?

These cuts have included the increased use of temporary workers, multi-tiered pay scales, health care cost shifting, and at the top of the list the end of defined-benefit pensions and retiree health care.

The question is will re-establishing the link between employer and employee encourage workers to share their labor with a company that is willing to commit to their workers present and future?

The answer to this question is often “yes” and the benefit most mentioned is retirement pensions. Legendary UAW President Walter Reuther often used the phrase “too old to work, too young to die” to describe aging autoworkers.

Walter knew the harsh physical demands of building automobiles often led to injuries and illnesses that affected a person’s ability to stay in the workforce. He also believed the employer that provided that work environment should also be responsible for the outcome – both the profits and the worker that helped make those profits.

Recent events have provided an opportunity to attract needed new talent, retain knowledgeable current employees, and develop a sustainable workforce. All without the balance sheet liability of a defined-benefit pension dragging down the stock price.

The recently ratified agreement between the UAW and John Deere includes ‘bonus” payments to workers at the time of their retirement. This concept along with the recent announcement by Fidelity Investments, our benefit provider, that they now offer annuities inside our 401k plan create a new opportunity.

According to Fidelity an annuity is a fixed sum of money paid to someone, typically for the rest of their life. Members could take this lump sum and purchase an annuity and be assured of a steady source of income for the rest of their life.

By allowing employees to purchase an annuity that creates a steady income stream in retirement the link between employer and employee would be strengthened. This benefit would create an incentive for people to join and stay with the company, have a shot at a secure retirement, and build a stable workforce that helps all of us.

Put another way: Would this retirement benefit keep you at work?

(free graphic via clipartix.com)