-

Shawn Fain, Trump, and Tariffs: What’s The Truth? - 1 day ago

-

Guest Opinion: Lawmakers Shouldn’t Undermine Missouri Voters - March 29, 2025

-

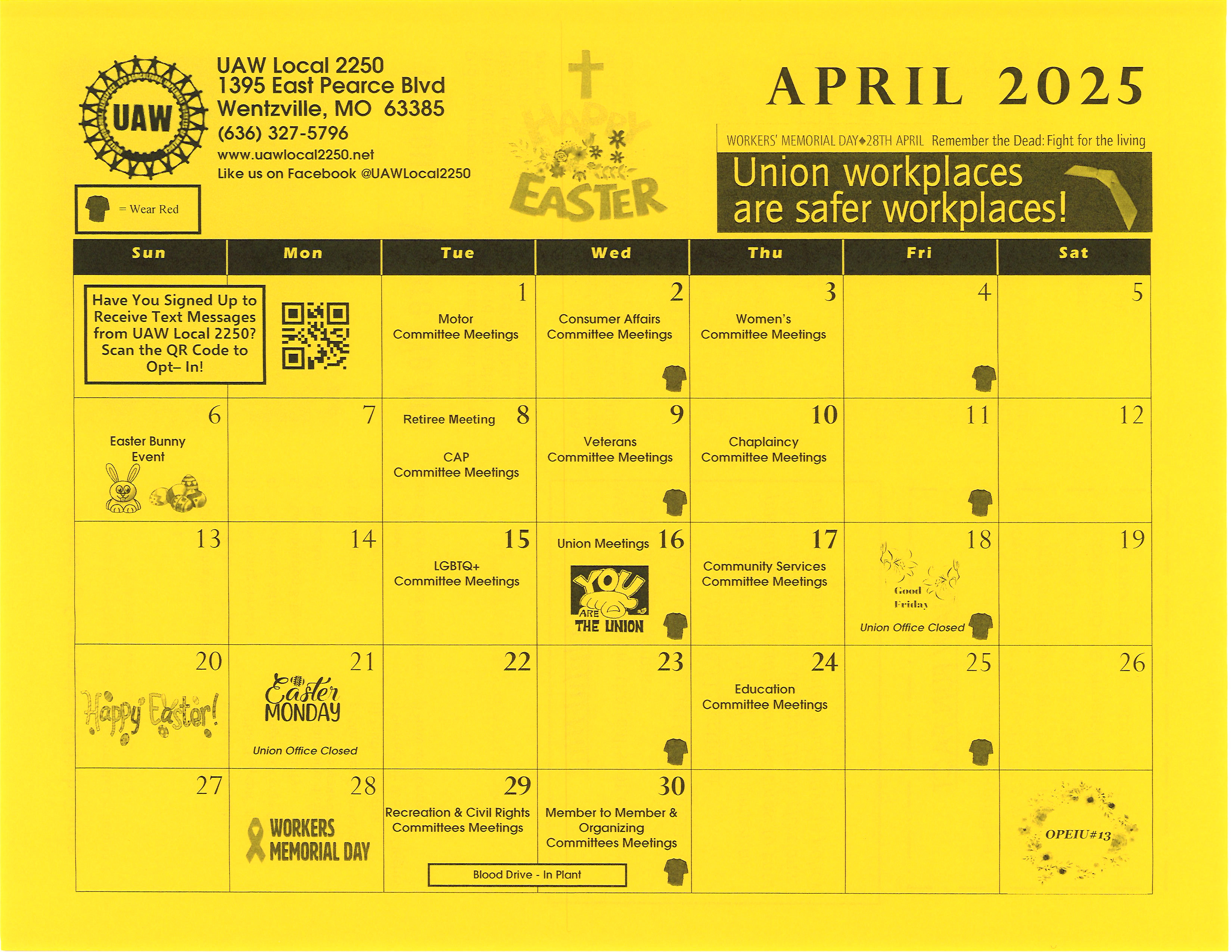

April Showers Bring More Activities! - March 28, 2025

-

The 2025 Missouri AFL-CIO Joint Legislative Report - March 27, 2025

-

P2: Phased Retirement For Tier 2/Progressive Members – A New Trend? - March 23, 2025

-

Sunday Guest Opinion: Education Department Cuts Damage The Working Class - March 22, 2025

-

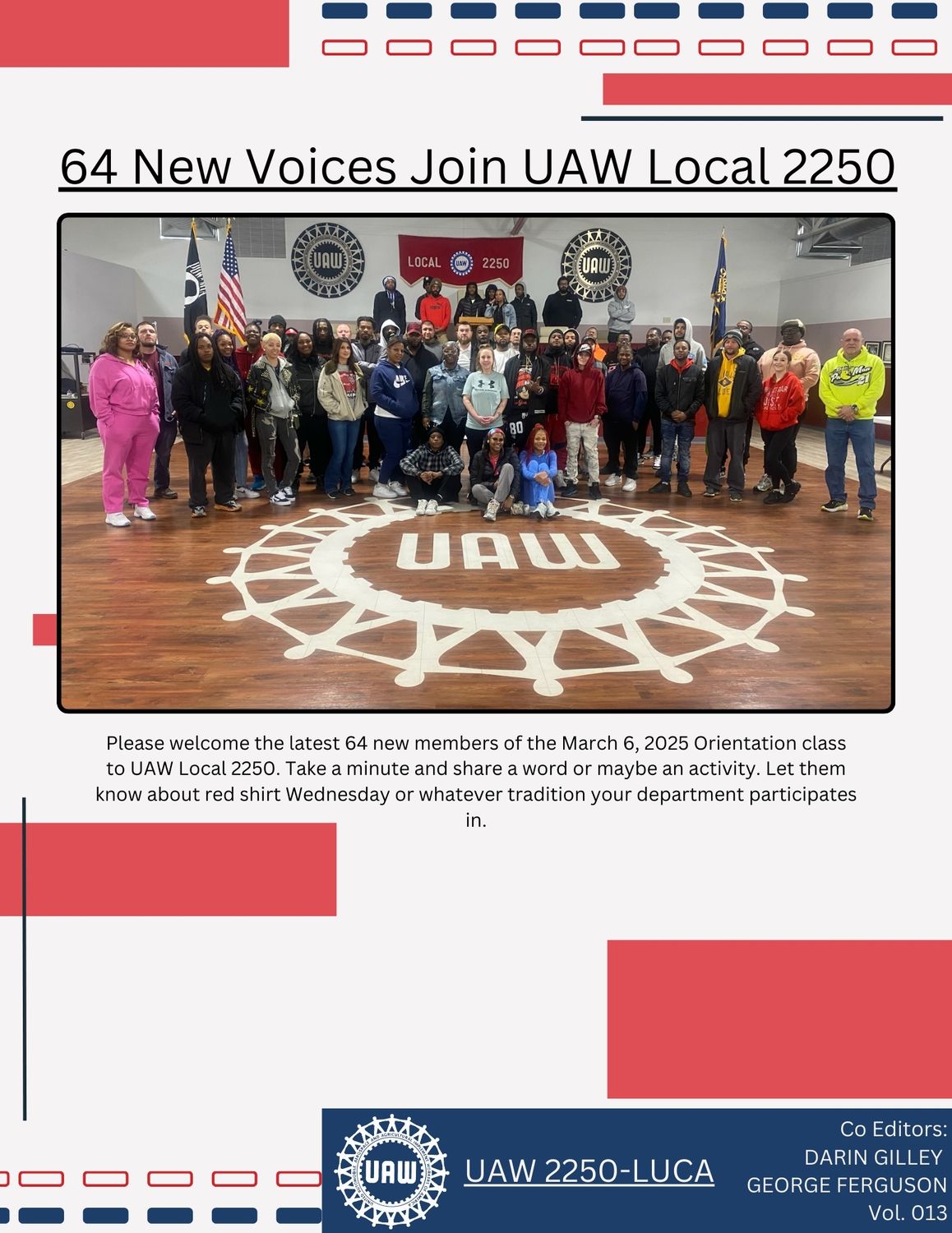

Newsline #13: New Members, Paid Leave, and The State Capitol! - March 21, 2025

-

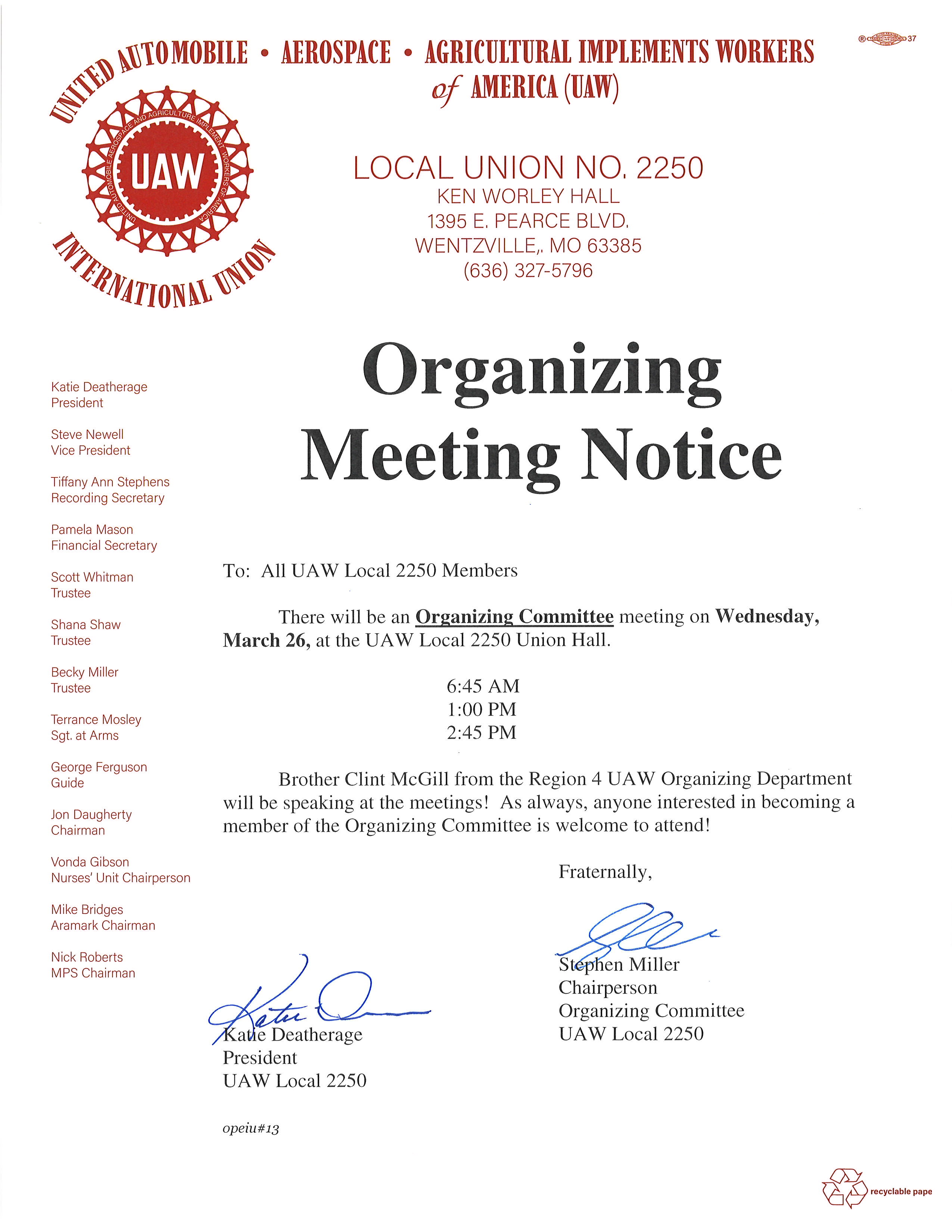

Check Out The Organizing Committee! - March 21, 2025

-

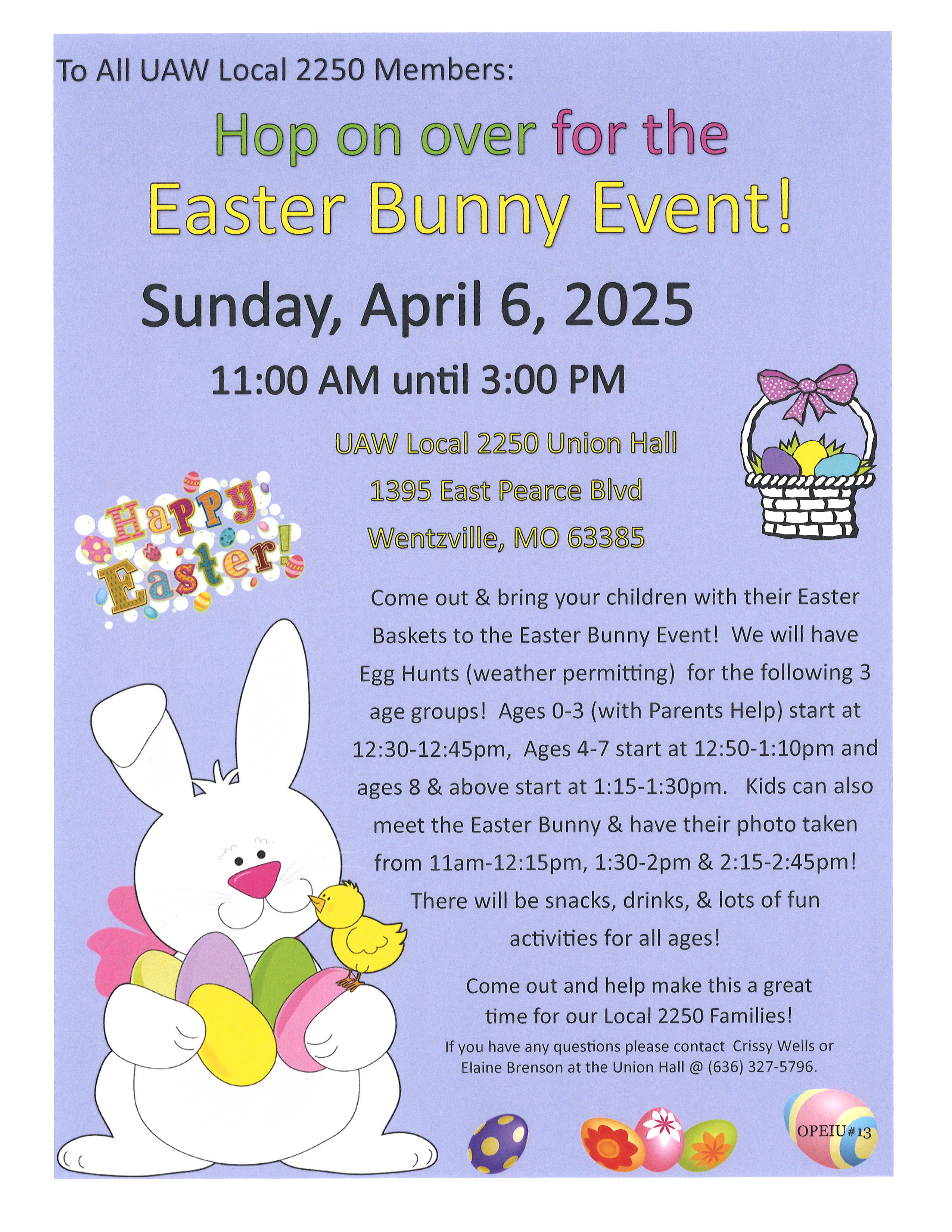

Hop To The Hall For a Great Easter! - March 21, 2025

-

The Missouri House of Representatives Goes After YOUR Vote and Benefits - March 20, 2025

Should Your GM/Fidelity 401k Offer an Annuity?

MarketWatch takes a peek into the future and finds Coming Sook: Fidelity 401k Annuities.

If your company’s 401(k) or 403(b) plan is managed by Fidelity Investments, your employer may soon start offering you the option of buying a lifetime annuity when you retire.

Fidelity, America’s biggest retirement plan provider, on Thursday announced the launch of Guaranteed Income Direct, a product that will allow employers to offer employees multiple annuity options from within the plan.

This is part of a growing trend, following the passage of the 2019 SECURE Act, which made it legally safer for employers to offer annuities.