-

Shawn Fain, Trump, and Tariffs: What’s The Truth? - 1 day ago

-

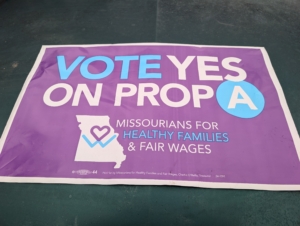

Guest Opinion: Lawmakers Shouldn’t Undermine Missouri Voters - March 29, 2025

-

April Showers Bring More Activities! - March 28, 2025

-

The 2025 Missouri AFL-CIO Joint Legislative Report - March 27, 2025

-

P2: Phased Retirement For Tier 2/Progressive Members – A New Trend? - March 23, 2025

-

Sunday Guest Opinion: Education Department Cuts Damage The Working Class - March 22, 2025

-

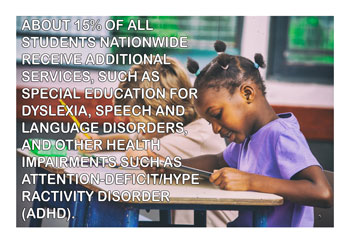

Newsline #13: New Members, Paid Leave, and The State Capitol! - March 21, 2025

-

Check Out The Organizing Committee! - March 21, 2025

-

Hop To The Hall For a Great Easter! - March 21, 2025

-

The Missouri House of Representatives Goes After YOUR Vote and Benefits - March 20, 2025

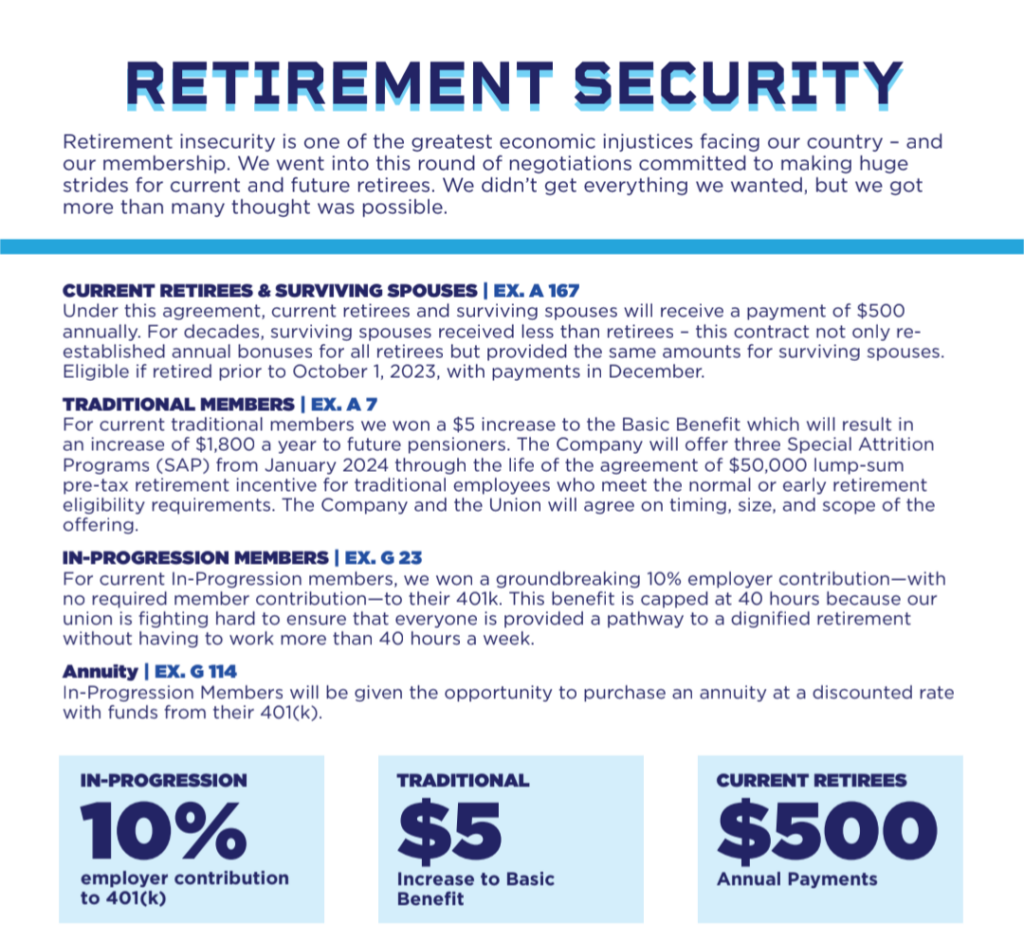

You Are Already Ahead In The RETIREMENT Game

How is your retirement plan compared to the rest of the country? Are you doing enough? The answer is Yes is you are a member of UAW Local 2250. CNBC takes a look at the state of Investor/Worker retirement in Here’s the average 401(k) savings rate as investors boost deferrals.…

How much to save in your 401(k)

Vanguard recommends saving 12% to 15% of your earnings every year, including employer contributions, to meet your retirement needs. The combined savings benchmark for Fidelity is 15%.

Typically, companies match employee deferrals up to a specified limit — and you should aim to contribute at least enough to get the full match, said Greenan from the Plan Sponsor Council of America.

You are already doing better than that thanks to the 2023 UAW/GM National Agreement. Currently, In-Progression/Tier 2 members receive a company contribution of 10% of wages added to their 401(k) without having to provide any matching funds. Every In-Progression/Tier 2 starts at a ten percent contribution rate. To reach the Fidelity benchmark of 15%, a member just needs to add five percent. Start saving and build your retirement plan!