-

Sunday Point/Counterpoint: Buying American - 15 hours ago

-

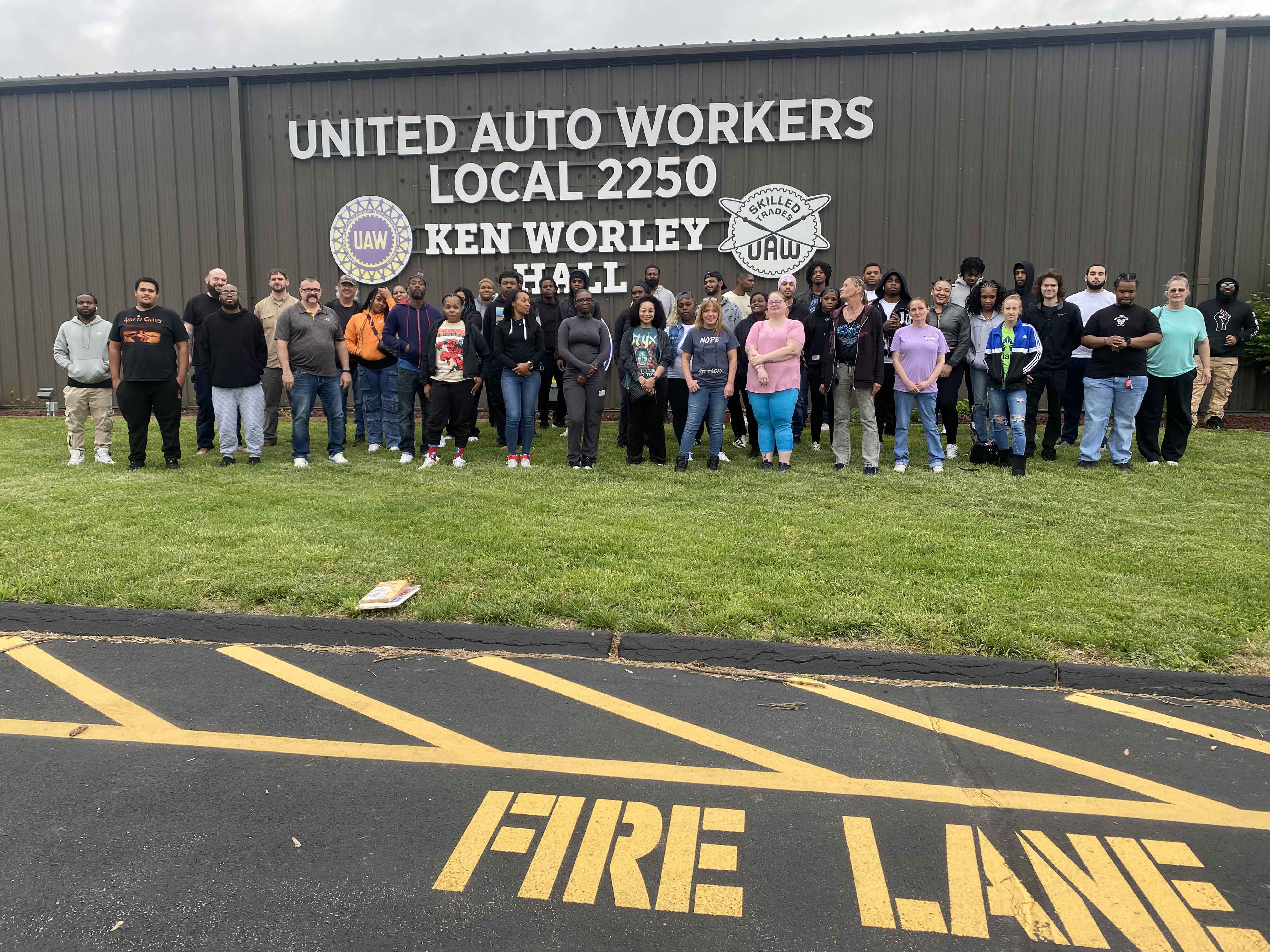

Say Hello to 51 new UAW Local 2250 members! - April 30, 2025

-

R4 Director Campbell and AD DeSpain Talk Tariffs, Politics, and More - April 30, 2025

-

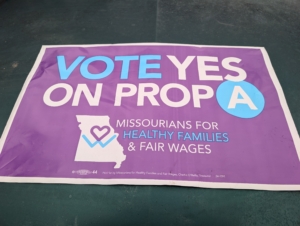

Paid Leave: The Courts Stand With Voters, Will Republican Senators? - April 30, 2025

-

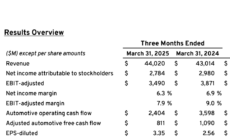

2025 Q1: Here’s What Profit Sharing Looks Like To Start The Year - April 29, 2025

-

This Week’s Missouri Labor Report - April 27, 2025

-

Women’s Committee Report: This Years Easter Event! - April 26, 2025

-

Guest Opinion: The Pro-Act Would Protect Against The Bosses Axe - April 25, 2025

-

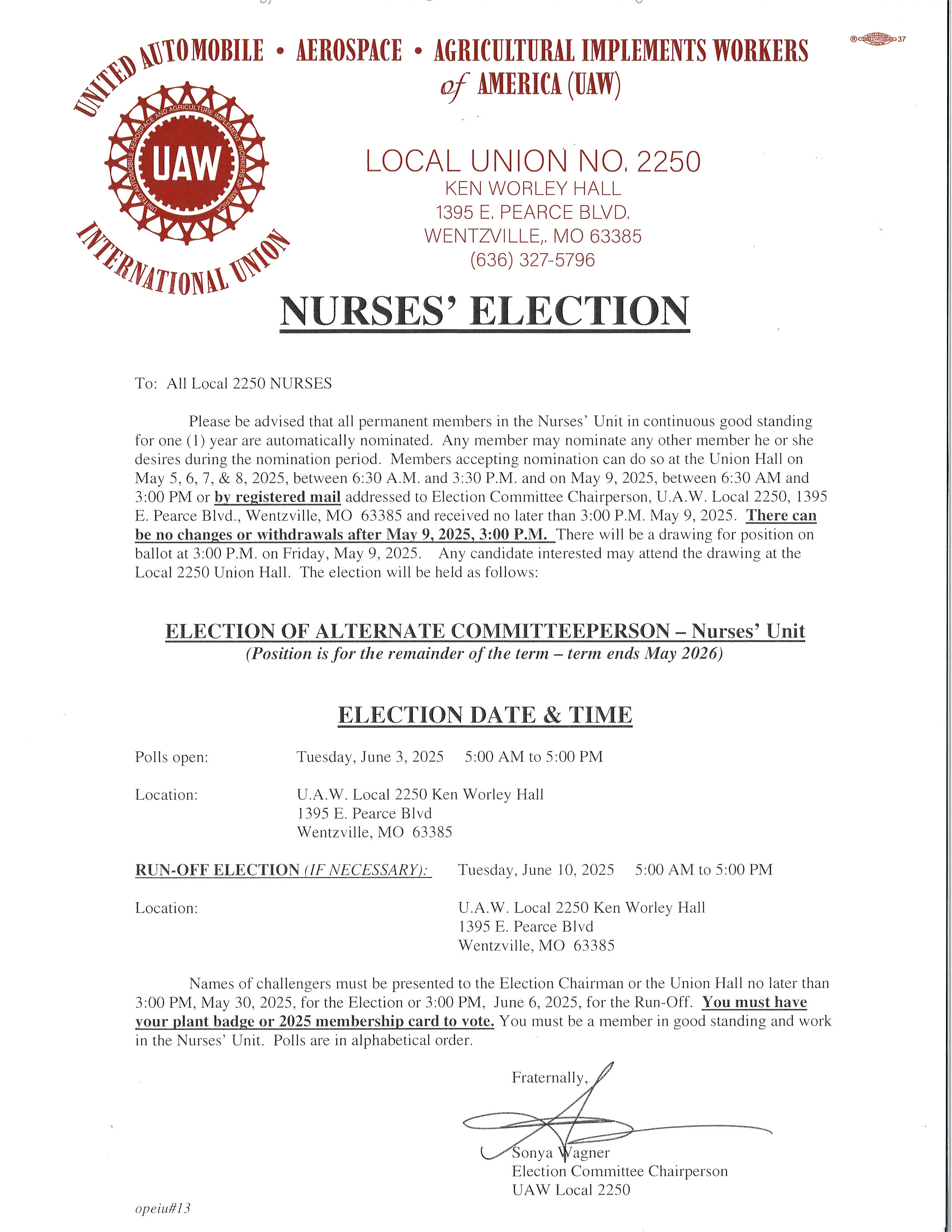

Attention Nurses: It’s Election Time! - April 25, 2025

-

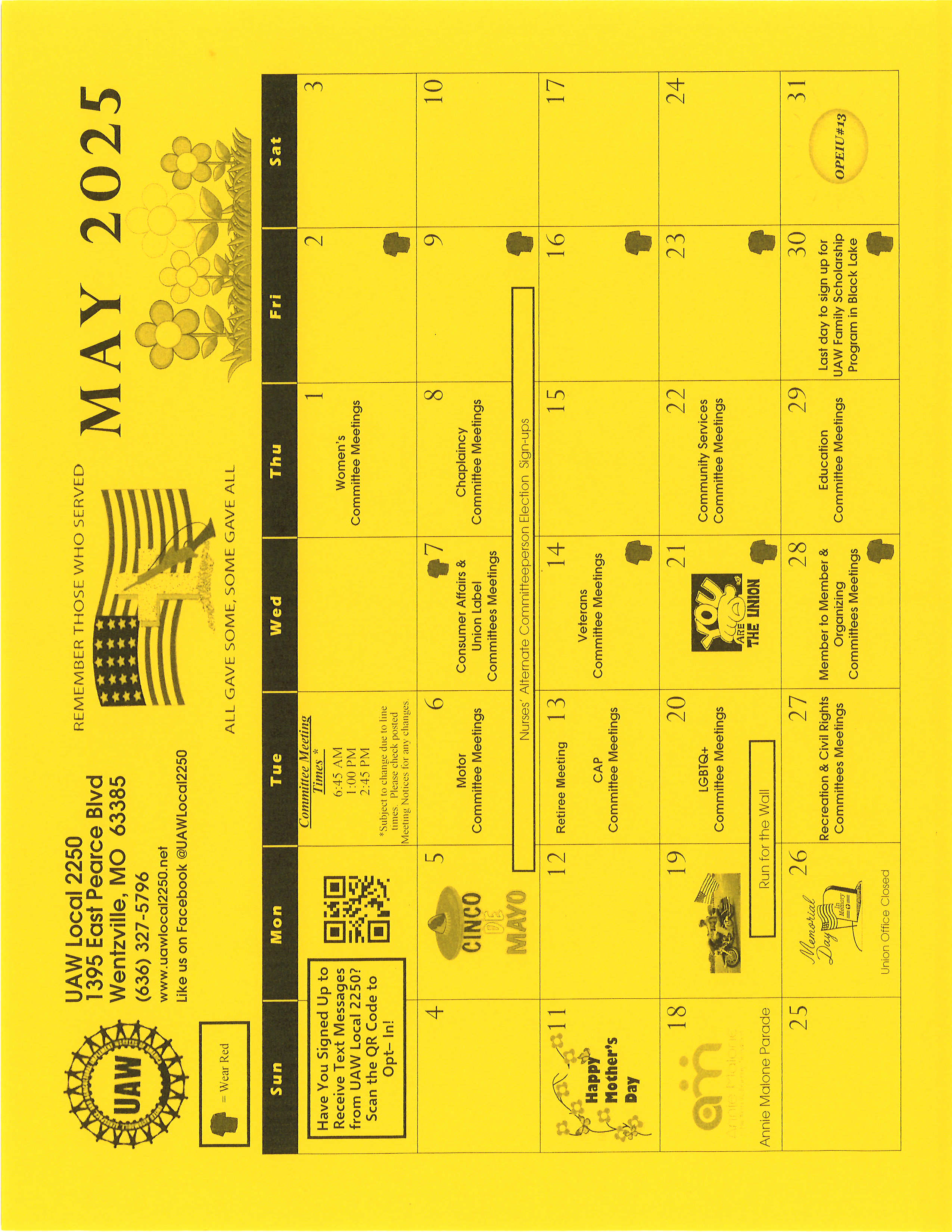

Cinco de Mayo, Memorial Day, Mothers Day, Meeting Day: !It’s May! - April 24, 2025

Weekly Labor Report: Mo Could Make Wentzville Child Care a Reality!

This week’s Missouri Labor Report focuses on a bill to help with the expense of childcare in the Show-Me state. On site child care is possible and would benefit many members. Keep an eye on how this progresses!

Missouri Labor Update

What Union Members need to know!

The Biggest Thing Going:

The Missouri House Actually Passes a Good Bill

In a rare event that many are calling “stunning” “out of character” “rare as a solar eclipse” and “a nice surprise,” the Missouri House of Representatives passed a bill this week that is entirely *gulps* GOOD! House Bill 269, sponsored by Rep. Brenda Shields (R-Buchanon), passed by a bipartisan 120-34 vote margin. The bill has a hefty price tag, but it’s a serious effort at doing something real to help alleviate the childcare crisis that workers and employers are currently facing. With large swaths of the state being “childcare deserts” where no provider is even available, and the average cost of childcare for an infant in Missouri (when available) costing parents around $9,500 a year, something clearly needs to be done. The bill seeks to help offset the skyrocketing cost of child care with 3 main pieces, let’s dig in:

Representative Brenda Shields (R-Buchanon) passed an important bill to address the Childcare crisis out of the House this week. You can learn more about Rep. Shields here.

Child Care Contribution Tax Credit Act

The First part of the bill would allow corporations (or technically any donor) to claim a tax credit for contributions to a childcare provider in an amount up to 75% of the contribution.

This is an incentive for companies and employers to work out large deals with childcare providers to cover the cost of their employee’s childcare, and then (heavily) subsidize the cost that the businesses pay.

EMPLOYER-PROVIDED CHILD CARE ASSISTANCE TAX CREDIT ACT

The Second piece of the legislation is financial assistance to employers that help provide child care to their employees. It would allow corporations to claim a tax credit of up to 30% of the qualified childcare expenditures they pay or incur concerning a childcare facility.

The goal of this piece is to reduce the cost of businesses starting their childcare programs and having care available on-site.

CHILD CARE PROVIDERS TAX CREDIT ACT

The third piece is direct assistance to childcare providers, which the legislation seeks to provide in two ways.

- It allows a childcare provider to claim a tax credit in an amount equal to the childcare provider’s eligible employer withholding tax.

- It allows providers to also claim a tax credit in an amount of up to 30% of the childcare provider’s capital expenditures.

The goal of this piece is to reduce the exorbitant cost of running a child care provider, by lowering operating costs and providing an incentive to make capital investments. The hope is that by reducing costs to providers existing providers will remain open, and more childcare centers will have the ability to open in currently underserved areas.

After coming out of the House the legislation now moves to the Senate, where the cost of the tax credits is sure to draw opposition from the far-right “Freedom Caucus.” The Missouri Labor Update will stay on this bill and keep you updated as it moves (or doesn’t move) through the legislative process.

It’s worth noting that when it comes to childcare THERE IS NO COMPREHESIVE SOLUTION WITHOUT MASSIVE INVESTMENT BY THE FEDERAL GOVERNMENT. The State budget is simply not big enough to provide the money necessary for quality, universal childcare. There are other models, such as giving the subsidy directly to parents, that may be preferable, but for where we are in 2025, with the legislature we have, HB 269 is unquestionably a very good step in the right direction.