-

Someone Is Trying To Change The Paid Leave You Voted For… - 17 hours ago

-

Get Your Newsline Here! - 2 days ago

-

Welcome 61 New Members to UAW Local 2250! - February 20, 2025

-

Great Read: How UAW Benefits Shaped An Immigrant Family - February 20, 2025

-

Cool 2250 Members Make The News! - February 19, 2025

-

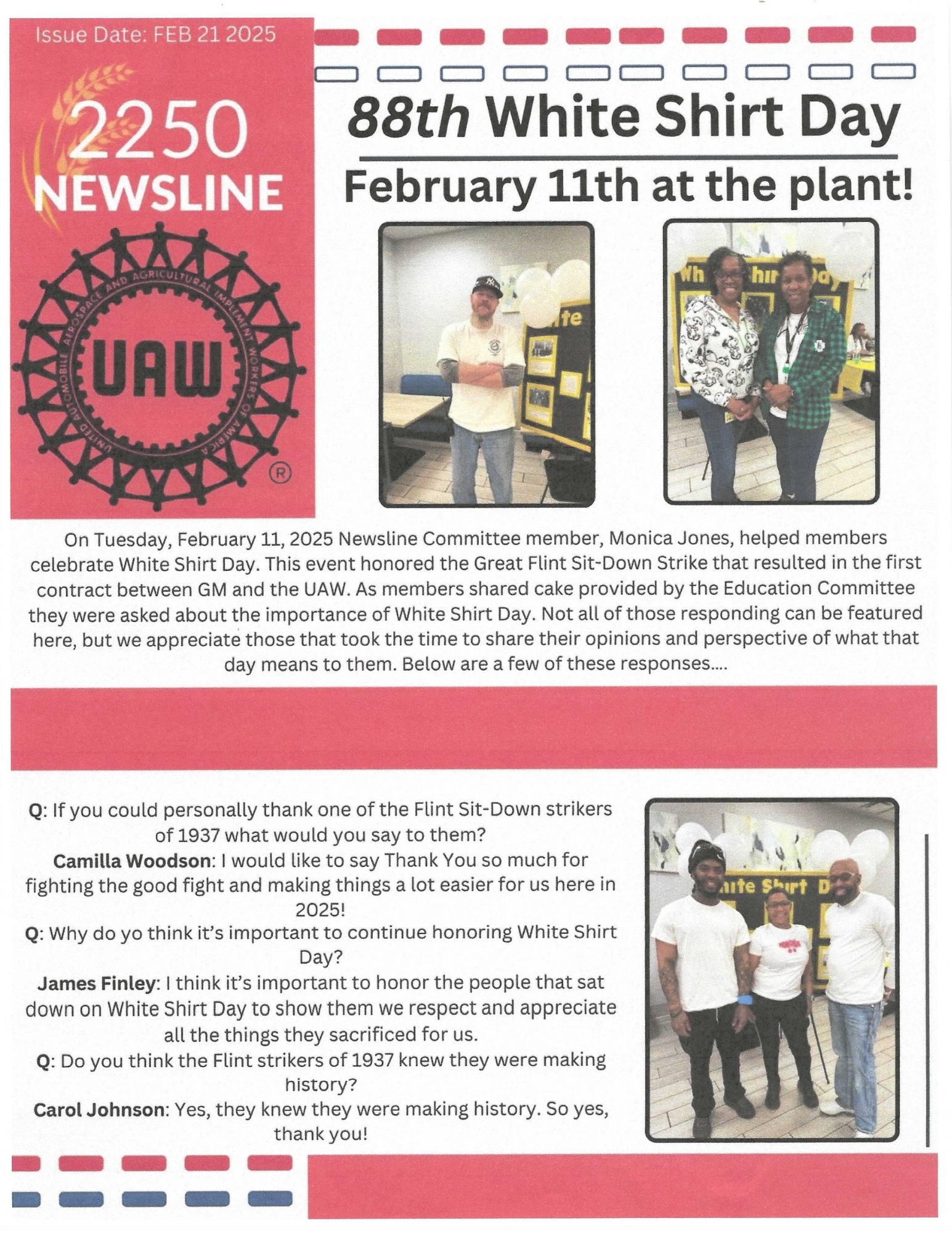

White Shirt Day: What It Means To You - February 18, 2025

-

This Week’s Missouri AFL-CIO Labor Report - February 16, 2025

-

Could You Use a $5000 Scholarship? Alliance Credit Union Can Help - February 15, 2025

-

Membership Meeting Next Wednesday! - February 15, 2025

-

Can You Believe That News Story? Find Out Here - February 12, 2025

Will An Annuity Give You A Better Retirement?

The 2023 UAW/GM National Agreement created an annuity benefit. This benefit is offered to members at a reduced rate. When combined with the increase in 401k company contributions of 10% many members will have a chance to create their own guaranteed income stream in retirement. What are the pros and cons of a retirement annuity? Find out here…

Advantages of annuities

1. Regular payments

In an era when employer pensions have gone all but extinct in the private sector, annuities can offer contract holders the opportunity to receive guaranteed monthly payments. These payments can provide regular, dependable income through retirement, or provide a bridge to Social Security if you chose to retire early. Here’s how an annuity compares to an IRA.

2. Lifetime income

Annuities can be structured to provide regular payments for the rest of your life — no matter how long you live. Not outliving your savings is a huge advantage touted by annuity providers. While anyone’s actual life expectancy is almost impossible to predict, the fear of running out of money in old age is a real concern for many Americans. Just keep in mind to secure a lifetime of guaranteed income, you’ll likely need to purchase a rider.

What is one of the biggest disadvantages?

High expenses and commissions

Cost is one of the biggest drawbacks of annuities. Expenses erode the owner’s returns, especially on a variable annuity where the value depends on the investment returns. Some annuity contracts are so complex that the full rate of the internal expenses is hard for the average person to understand.

Annuities are typically sold by insurance agents, not financial advisors. That means they earn a commission on the products they sell you. While the commission is usually baked into the annuity contract, it can amount to anywhere from 1-10 percent of the total value of your contract.

The new annuity benefit in the national agreement addresses this disadvantage by providing a one percent commission instead of the industry standard two percent. It’s true that the defined benefit pension enjoyed by traditional members was not obtained in the current contract. That said, if you are interested in a guaranteed monthly income check in retirement take a minute and find out more about this annuity benefit. A good place to start is by clicking here.