-

Your Weekly Missouri AFL-CIO Labor Report - 9 hours ago

-

Someone Is Trying To Change The Paid Leave You Voted For… - February 22, 2025

-

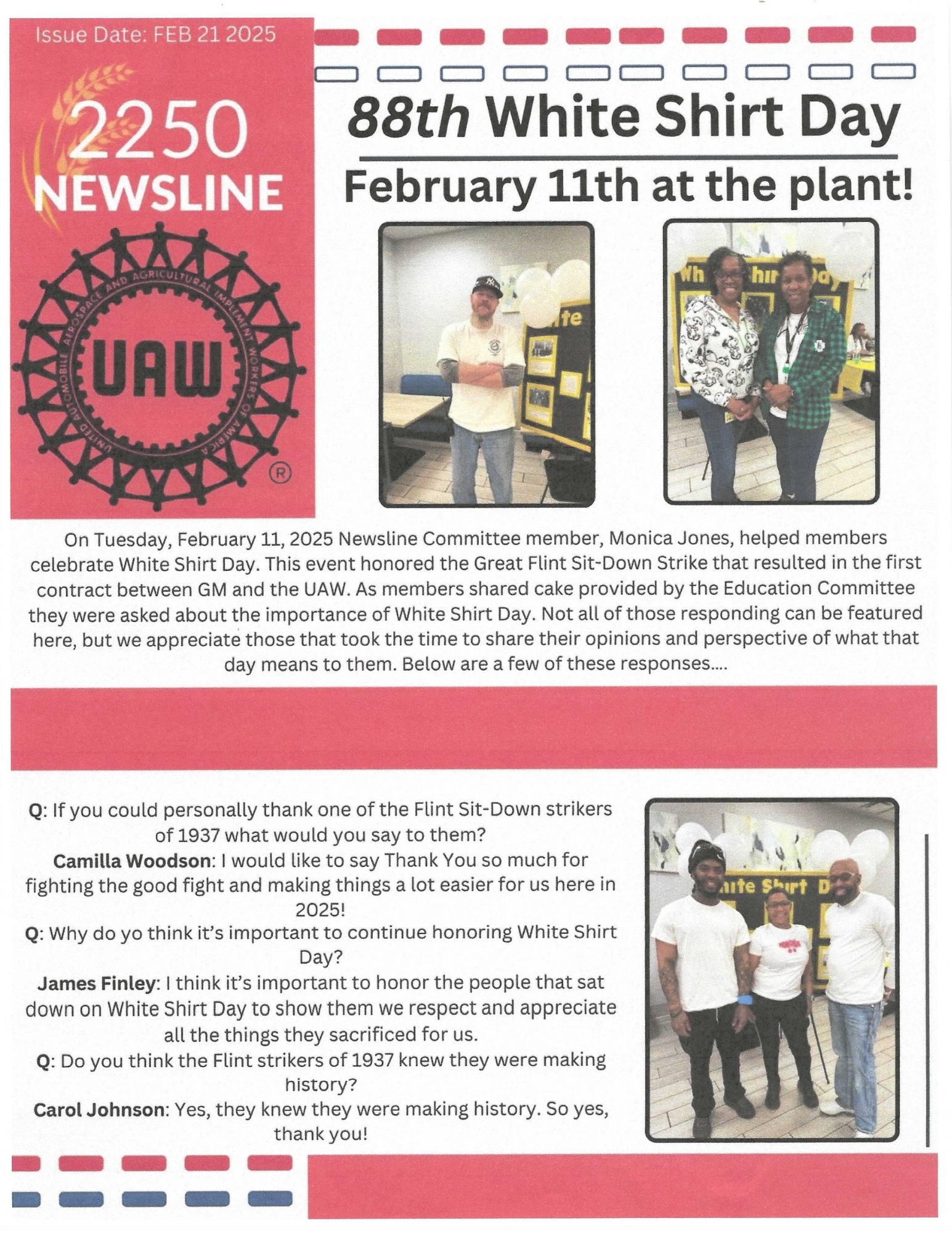

Get Your Newsline Here! - February 21, 2025

-

Welcome 61 New Members to UAW Local 2250! - February 20, 2025

-

Great Read: How UAW Benefits Shaped An Immigrant Family - February 20, 2025

-

Cool 2250 Members Make The News! - February 19, 2025

-

White Shirt Day: What It Means To You - February 18, 2025

-

This Week’s Missouri AFL-CIO Labor Report - February 16, 2025

-

Could You Use a $5000 Scholarship? Alliance Credit Union Can Help - February 15, 2025

-

Membership Meeting Next Wednesday! - February 15, 2025

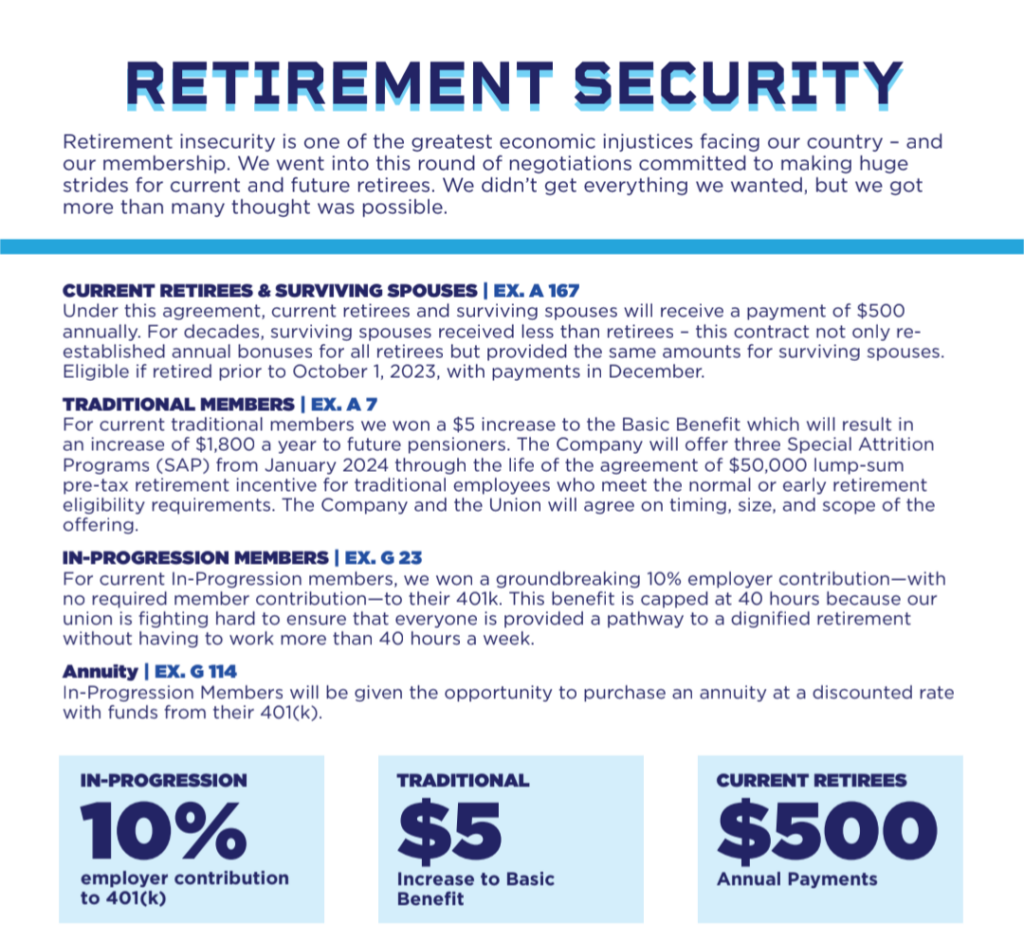

You Are Already Ahead In The RETIREMENT Game

How is your retirement plan compared to the rest of the country? Are you doing enough? The answer is Yes is you are a member of UAW Local 2250. CNBC takes a look at the state of Investor/Worker retirement in Here’s the average 401(k) savings rate as investors boost deferrals.…

How much to save in your 401(k)

Vanguard recommends saving 12% to 15% of your earnings every year, including employer contributions, to meet your retirement needs. The combined savings benchmark for Fidelity is 15%.

Typically, companies match employee deferrals up to a specified limit — and you should aim to contribute at least enough to get the full match, said Greenan from the Plan Sponsor Council of America.

You are already doing better than that thanks to the 2023 UAW/GM National Agreement. Currently, In-Progression/Tier 2 members receive a company contribution of 10% of wages added to their 401(k) without having to provide any matching funds. Every In-Progression/Tier 2 starts at a ten percent contribution rate. To reach the Fidelity benchmark of 15%, a member just needs to add five percent. Start saving and build your retirement plan!