-

Someone Is Trying To Change The Paid Leave You Voted For… - 4 hours ago

-

Get Your Newsline Here! - 1 day ago

-

Welcome 61 New Members to UAW Local 2250! - February 20, 2025

-

Great Read: How UAW Benefits Shaped An Immigrant Family - February 20, 2025

-

Cool 2250 Members Make The News! - February 19, 2025

-

White Shirt Day: What It Means To You - February 18, 2025

-

This Week’s Missouri AFL-CIO Labor Report - February 16, 2025

-

Could You Use a $5000 Scholarship? Alliance Credit Union Can Help - February 15, 2025

-

Membership Meeting Next Wednesday! - February 15, 2025

-

Can You Believe That News Story? Find Out Here - February 12, 2025

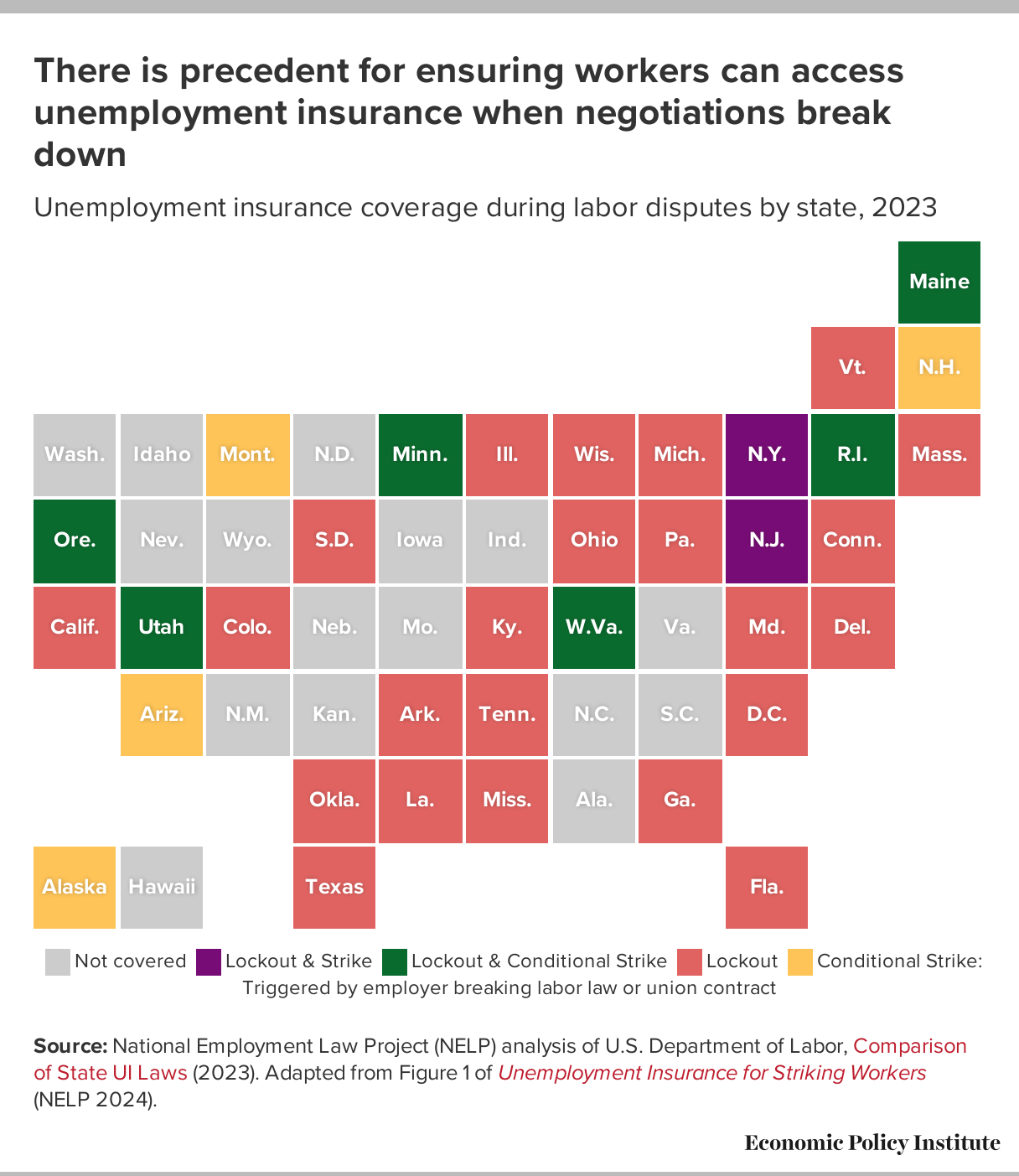

Higher Wages Are Better Than Tax Cuts

The Economic Policy Institute answers the age-old question “Which is better, higher wages of tax cuts”? Thanks to the St. Louis Labor Tribune for publishing this!

But most importantly, these ideas do nothing to fix the biggest problem U.S. workers have faced in recent decades — that employers have managed to hijack policies across a range of issues areas to help them suppress wage growth.

Since 1979, this wage suppression has cost middle-income workers dearly: for somebody earning the median wage and working full time, year-round, their annual earnings would be $19,000 higher today if wages had risen in line with overall economic growth. This cost dwarfs other economic pressures in their lives: Even if we cut the taxes these workers pay to zero, their income would rise by less than a third of what wage suppression has taken from them.

One way to see this is that productivity — the amount of income generated in an average hour of work in the economy — has risen by 1.4 percent per year since 1979, but pay for the 80 percent of workers who are not managers in the economy has risen by just 0.6 percent per year. In other words, while ordinary workers got less than half of their fair share of the income generated by productivity growth over this period, highly paid workers and corporate shareholders made out like bandits.

Yikes, employers have been holding wages down but can’t tax cuts make up for it?

Have taxes added to this pressure on family incomes? Not even a little. In fact, between 1979 and 2019, the average federal tax rate for households with children in the middle-fifth of the income distribution fell significantly, from 17.6 percent to 12.3 percent. This fall happened during both Republican and Democratic administrations. If we cut federal taxes still owed by these middle-fifth families in 2019 all the way to zero, this would raise annual earnings of full-time, full-year wage earners by less than $6,000 — not even a third of what wage suppression took from them.

If policymakers want to provide transformative help to middle-income families, enacting policies to fight this wage suppression should be front and center. These policies exist and they work, but they do not get near the attention they deserve.

The long and short of it: don’t fall for a bait and switch candidate promise of tax cuts that come from politicians that don’t support higher wages and unions.

(graphic by Mohammad Hassan, Pixabay)